Why 2023 is a breakout year for batteries

This article is from The Spark, MIT Technology Review’s weekly climate newsletter. To receive it in your inbox every Wednesday, sign up here.

If you stop to think about it for long enough, batteries start to sound a little bit like magic.

Seriously, tiny chemical factories that we carry around to store energy and release it when we need it, over and over again? Wild.

Over the time I’ve spent writing about climate, and even before that in my previous life as an engineer, I’ve cultivated a somewhat major obsession with batteries. And it’s not just because the concept is so mind-bending: batteries are set to play a starring role in the renewable energy transition, both in EVs and on the grid.

So when the new year rolled around and we here at MIT Technology Review started to work on a series called “What’s Next in Tech,” I knew exactly what I wanted to write about. The result went live this morning—check it out for all my predictions on what’s going to be important this year in battery technology. And for the newsletter this week, let’s dive a bit deeper on batteries’ role in climate action, why I think they’re so exciting, and where the technology is going.

The energy puzzle

Stored energy is absolutely key to our way of life. The ability to flick the lights on, cook dinner, or drive to work relies on energy that we can unleash when we need it. Today, the vast majority of this energy storage is in the form of fossil fuels. Coal, natural gas, oil—all forms of fossil fuels contain energy in their chemical bonds, remnants of plants and animals that lived millions of years ago. These fuels are burned when we need them at power plants or in vehicles, transforming that energy into a form we can use.

But now we’re trying to stop burning fossil fuels. We’ve got great candidates for new energy sources, especially solar and wind. But these sources are “intermittent,” a long word to say that the sun doesn’t always shine and the wind doesn’t always blow.

So we need a way to take the electricity generated by wind turbines and solar panels and store it, and that turns out to be more complicated than it sounds.

A quick aside here to say that there are other ways to at least help address intermittency. Adding baseload and dispatchable energy sources like nuclear, geothermal, and hydropower can somewhat balance intermittent solar and wind. And better, longer transmission lines to move electricity around can also help.

But back to energy storage.

There’s a world of ways to store energy, some of which I’ve covered. Take physical energy storage. The most familiar example of this is pumped hydropower, where water is pumped up a hill from one lake into another, or held back by a dam. Pumped hydro actually accounts for about 90% of the world’s energy storage today.

Pressurized gas can also be used to store energy. Storing heat is another approach, and so-called thermal batteries could play a key role, especially in industrial settings.

But when it comes down to it, chemistry is an elegant way to store energy, and one that can be replicated pretty much anywhere. Which brings us to batteries.

A periodic table of possibilities

When it comes to batteries, the world has widely converged on one element: lithium. Lithium-ion batteries make an appearance in everything from phones and laptops to EVs and even massive installations at data centers or on the grid.

And fair enough. These batteries can pack a lot of energy into a relatively small space, they charge and discharge pretty quickly, and they’re getting cheap.

But the dominance of lithium-ion batteries is partly due to their status as the reigning technology. We know how to make lithium-ion batteries really well because they got developed for personal electronic devices decades ago. So now they’re getting incorporated into new applications, like EVs and even grid storage.

But there’s a whole periodic table out there, and there are some technologies that could really upend things—and might even be a better fit for these new industries we’re setting up to combat the climate crisis.

- EVs work okay, but what if their batteries could go way farther on a single charge? Solid-state lithium-metal batteries could deliver that.

- EVs are pretty expensive today, what if they were way cheaper? Sodium-ion batteries might be the answer.

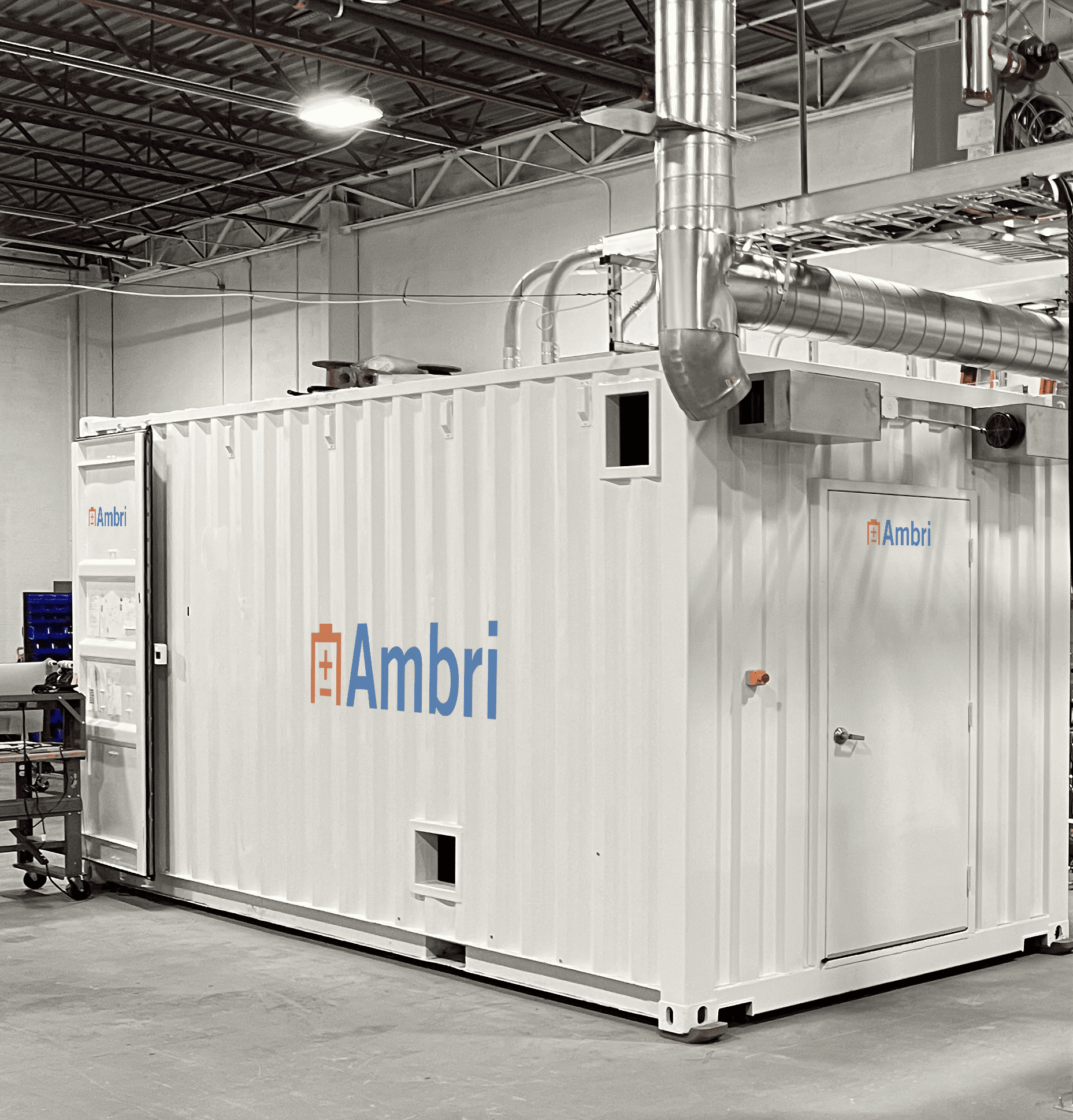

- What if size and weight weren’t an issue at all, and I just wanted to store solar power for days or weeks, as cheaply as possible? Say, for grid storage. Iron batteries could answer that call.

Building new types of batteries is hard, and plenty of startups have failed with dreams like these. But I think it’s so interesting to see all these new approaches popping up to this seemingly simple task. The closer you look, the more complicated and interesting it becomes.

Do check out my story for more on some of the technologies I mentioned here, and for my predictions for 2023—and let me know what you think I missed!

Another thing

In case you missed it over the holidays, my colleague James Temple published a story about a startup that says it’s begun releasing small amounts of tiny particles into the atmosphere, a practice that could be used to tweak the climate.

The possibility of reflecting sunlight back into space in this way, called solar geoengineering, is controversial. Some experts say the technology could save lives by lowering temperatures while we work on addressing climate change, but the side effects could be difficult to untangle and are, at this point, impossible to predict.

There’s a world of debate on solar geoengineering, with some arguing we shouldn’t even go near the concept. But up to this point, even proponents of research in the field had agreed on the need for careful experimentation and public engagement. That is, until a startup decided to just start dabbling with the practice, and selling cooling credits to monetize it.

The company’s experiments are tiny: they’re releasing just a few grams of sulfur in weather balloons. Partly because of their small scale, they’re probably not illegal, as Ted Parson wrote in Legal Planet in response to the story.

But the launches, which the company’s founder acknowledges are partly about stirring the pot, show how easy it would be for companies, nations, or individuals to jump into geoengineering, despite a lack of understanding about its effects. There’s no real regulations in the space right now.

For more on the startup’s efforts, check out James’s story. He also recently wrote about a US government effort to develop a research plan for geoengineering.

Keeping up with climate

In a dramatic start to 2023, a winter heat wave smashed January records across Europe. (Washington Post)

Researchers are experimenting with installing solar panels over crops and grazing land. The panels can generate electricity while keeping plants and livestock cool. (MIT Technology Review)

Iron-air battery maker Form Energy is building a factory in Weirton, West Virginia. The site represents a $760 million total investment. (Canary Media)

→ Iron-based batteries could help stabilize the electricity grid. (MIT Technology Review)

One chart shows how China dominates the solar supply chain, from raw materials through solar module production. (Canary Media)

The biodiversity crisis is linked to climate change. But it’s also a distinct issue that’s largely taken a back seat. David Wallace-Wells explains why that’s a problem. (New York Times)

California’s wildfire season was relatively mild in 2022. While a similar number of fires started, much less area burned than in previous seasons, partially because of favorable weather. (The Guardian)

→ What complex fire models can tell us about the future of California’s forests. (MIT Technology Review)

Making aluminum can generate harmful greenhouse gases called PFCs, and facilities in China make way more than anywhere else in the world. There’s an easy fix: automation. (Grid News)

Last year was a breakout year for US battery production. In 2022, companies collectively announced plans for over $73 billion in battery and EV production and battery recycling. (NPR)