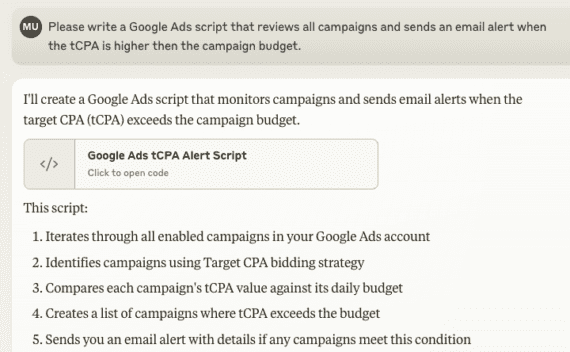

Better Audience Targeting in Google Ads

Google Ads continues to shift its focus from keywords to campaign types, such as Performance Max and Demand Gen, making audiences more critical than ever. Google has enhanced its audience targeting capabilities in Display campaigns to resemble those on Meta, LinkedIn, and other social channels.

Custom audiences

Search and Shopping campaigns take advertisers only so far. Display campaigns can help by building top-of-funnel prospects via custom audiences.

A “custom audience” is any group of consumers chosen by an advertiser, such as:

- Visitors to a contact-us page who don’t convert,

- Email newsletter subscribers,

- Searchers with specific needs, such as queries for “electrician services” or “wireless headphones,”

- Shoppers who browse a category of websites, such as those similar to ESPN,

- Searchers who query “wireless headphone” terms but don’t browse ESPN-like sites.

Depending on the campaign type, Google either targets these audiences or uses them as a signal. For example, a Display campaign would target prospects in “electrician services” for an in-market audience. A Performance Max campaign would use “electrician services” as a signal and show ads to prospects inferred by Google.

Custom audiences are limitless, which is why advertisers should continually test to identify the top performers.

Creating custom audiences

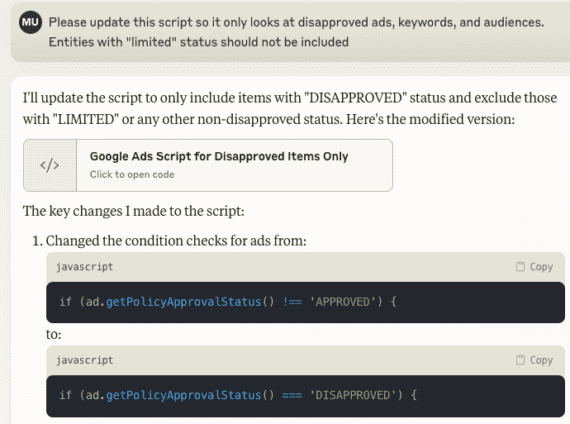

The most common custom audience is visitors to a website — individual pages or combinations. For instance, here are visitors to a product page who did not convert. They viewed the “/products” URL but not the “/thank-you.”

This custom audience is visitors who viewed the “/products” URL but not the “/thank-you.” Click image to enlarge.

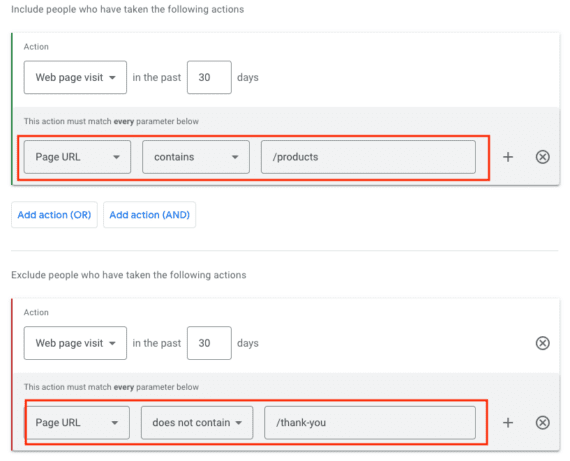

Yet targeting is more creative with custom segments, which, like website audiences, are located in the Audience Manager. There are two types of custom segments:

- “People with any of these interests or purchase intentions,”

- “People who search for any of these terms on Google.”

The options are similar, but “interests” includes websites visited, apps used, and content consumed, versus searchers who query specific terms. Thus “interests” are macro targeting while searches are micro.

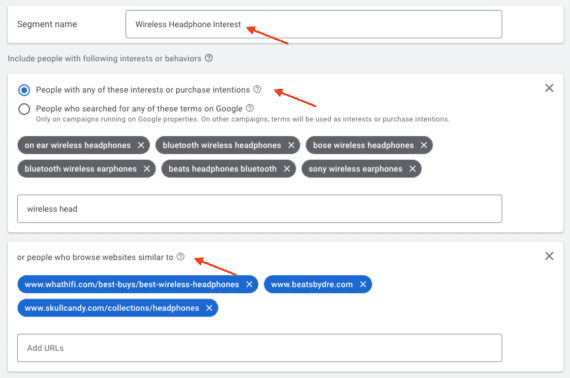

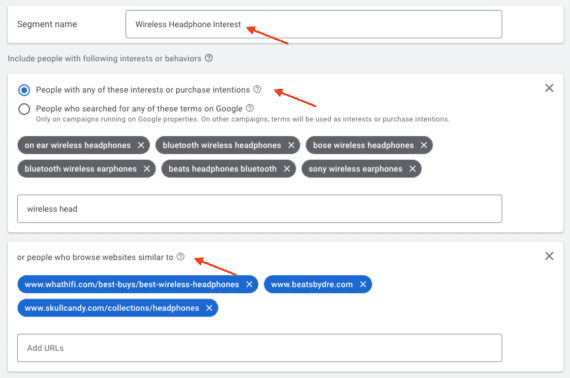

Here is a custom interest segment for wireless headphones. I’ve included a few headphone terms and sites that prospects visit.

This custom interest segment includes prospects’ headphone terms and related websites. Click image to enlarge.

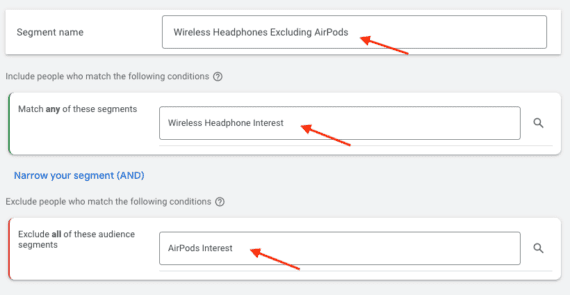

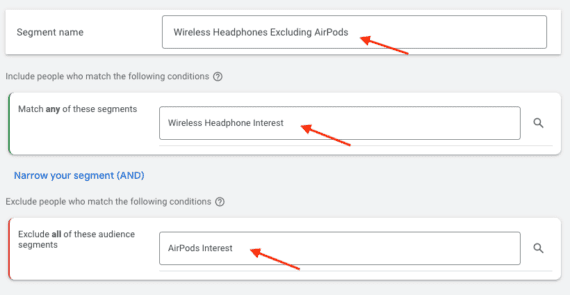

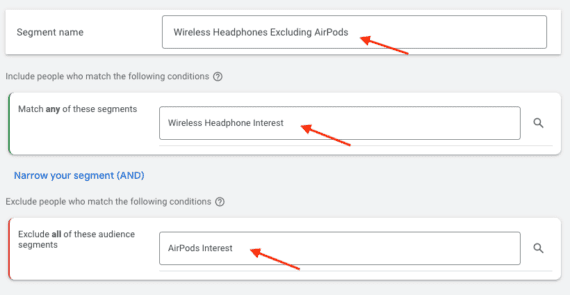

I could narrow the segment by excluding prospects interested in Apple AirPods. I could then create a separate segment targeting “AirPod” terms, and even combine the two for a new segment.

Segments can exclude other segments or interests. This example excludes prospects who are interested in AirPods. Click image to enlarge.

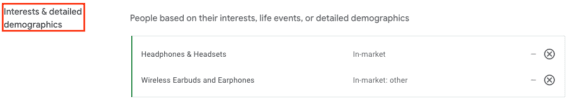

Combined segments can include “Interests & detailed demographics,” not just other custom segments. Hence I could add Google-defined headphone users to my combined segment.

Combined segments can include “Interests & detailed demographics,” not just other custom segments. Click image to enlarge.

The result is seemingly endless potential audiences, general and specific, to test across campaign types. Perhaps one custom segment works better as a signal in Performance Max than as a target in Display.

Be creative! That’s the takeaway. Targeting in Google Ads may not be as granular as Meta or LinkedIn, but it is essential for scaling your account.