Hybrid Ecommerce Serves B2C and B2B

Direct-to-consumer brands that add wholesaling can benefit from a hybrid ecommerce platform, one that caters to consumers and businesses.

DTC companies manufacture their own products and typically begin selling directly to individuals. The websites are rich with product information and polices and procedures. Employees receive appropriate training.

But then the company enters the wholesale market. Its customers are humans placing occasional orders and businesses with a slew of new requirements.

These DTC brands have three options for ecommerce.

- Establish separate B2C and B2B websites, supporting each with distinct data, product catalogs, and fulfillment practices.

- Develop a headless or configurable ecommerce infrastructure that supports two sites — consumer and business — from a single data source.

- Transform the current consumer platform into a hybrid, serving businesses and consumers with one dynamic interface.

Hybrid Website

Each approach has merit, but the hybrid B2C and B2B option is likely the best choice for small and midsized merchants. The approach lets a brand use its existing website to add B2B ordering.

The hybrid site unifies the product catalog without much development. The company’s established fulfillment workflow can process B2B orders. Hence the hybrid model is easier and less expensive.

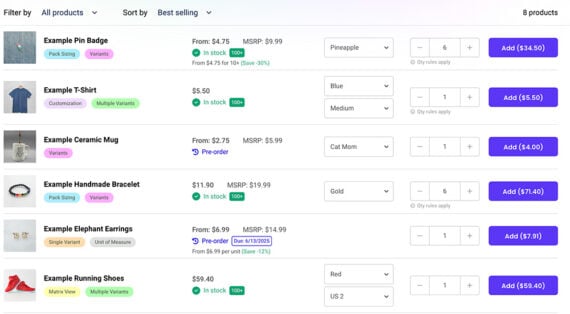

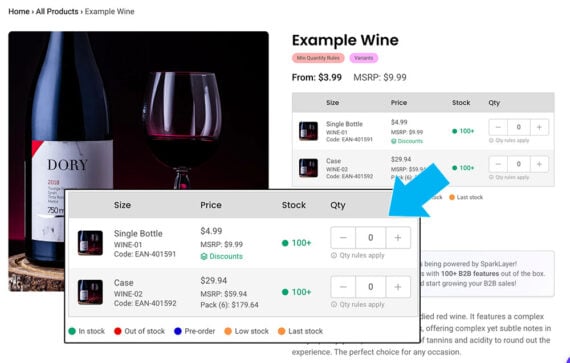

This hybrid ecommerce site uses Shopify and SparkLayer, an integration app. When the B2B buyer logs in, the product detail page displays wholesale pricing.

5 Vital Features

Popular ecommerce platforms such as Shopify, BigCommerce, NetSuite, and others offer many third-party apps to transform a consumer ecommerce site into a functional hybrid in minutes.

Prominent apps include SparkLayer, Wholesale Gorilla, and Wholesale All in One. Each adds B2B ordering to a live consumer shop.

A hybrid storefront will do more than show discounted or tiered pricing. It will provide wholesale customers — distributors, other retailers — with five essential features.

Wholesale payments

A good B2C-B2B hybrid allows wholesale buyers to pay via invoice with approved terms. A recognized, account-holding purchasing agent can visit the site, log in, and place an order — without typing in a credit card number.

The agent could also pay with existing consumer options, such as a credit card, hosted payment services (Apple Pay, Amazon Pay, etcetera), PayPal, or even buy-now pay-later.

Custom discounts

B2B customers often negotiate unique pricing based on order volume and contract terms, for example. A hybrid site should offer custom pricing configurations that load seamlessly when a wholesale buyer logs in.

Done well, the implementation would:

- Display unique pricing per SKU for logged-in B2B buyers.

- Show automatic volume discounts that adjust as quantities increase.

- Offer tiered pricing based on customer groups.

- Enable B2B customer-specific promo codes.

Easy orders and reorders

A hybrid site will allow a wholesale buyer to place orders directly from a product detail page. The page will reflect the buyer’s pricing and package but is otherwise similar to consumers’ experiences.

Moreover, B2B buyers should be able to:

- Order via an uploaded and formatted CSV file,

- Order from a table-like product matrix,

- Place one-click reorders,

- Create automatically fulfilled offers on a schedule.

Account history

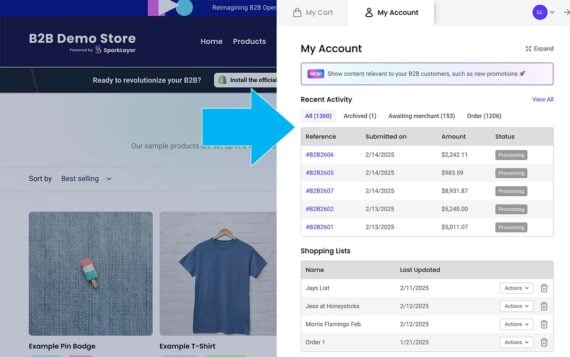

Every major ecommerce platform offers some form of account history, but B2B customers often require more in-depth information about orders and the overall agreement with the seller.

This expanding information typically includes:

- Invoice status. Paid and past due invoices and the total outstanding balance.

- Agreements. Payment terms and negotiated item prices.

- Pricing history. Current, past, and future prices (for pending increases).

Multiple users

A wholesale customer with retail outlets or distribution channels could have multiple buyers, marketers, receivers, and accountants needing access to account info. These individuals could share credentials, but it’s a much better experience to provide each with a unique account, role, and access.

For example, a receiver needs only to log in and track orders, not place orders or view payments.

DTC + B2B

A hybrid ecommerce site is a practical solution for DTC brands expanding into wholesale. The approach integrates B2B features into an existing B2C site to serve both individuals and businesses efficiently.

The result is reduced operational complexity and seamless experiences for all customer types.