BOX ELDER COUNTY, Utah – On a bright afternoon in August, the shore on the North Arm of the Great Salt Lake looks like something out of a science fiction film set in a scorching alien world. The desert sun is blinding as it reflects off the white salt that gathers and crunches underfoot like snow at the water’s edge. In a part of the lake too shallow for boats, bacteria have turned the water a Pepto-Bismol pink. The landscape all around is ringed with jagged red mountains and brown brush. The only obvious sign of people is the salt-encrusted hose running from the water’s edge to a makeshift encampment of shipping containers and trucks a few hundred feet away.

This otherworldly scene is the test site for a company called Lilac Solutions, which is developing a technology it says will shake up the United States’ efforts to pry control over the global supply of lithium, the so-called “white gold” needed for electric vehicles and batteries, away from China. Before tearing down its demonstration facility to make way for its first commercial plant, due online next year, the company invited me to be the first journalist to tour its outpost in this remote area, a roughly two-hour drive from Salt Lake City.

The startup is in a race to commercialize a new way to extract lithium from rocks, called direct lithium extraction (DLE). This approach is designed to reduce the environmental damage caused by the two most common traditional methods of mining lithium: hard-rock mining and brining.

Australia, the world’s top producer of lithium, uses the first approach, scraping rocks laden with lithium out of the earth so they can be chemically processed into industrial-grade versions of the metal. Chile, the second-largest lithium source, uses the second: It floods areas of its sun-soaked Atacama Desert with water. This results in ponds rich in dissolved lithium, which are then allowed to dry off, leaving behind lithium salts that can be harvested and processed elsewhere.

The range of methods known as DLE use lithium brine too, but instead of water-intensive evaporation, they all involve advanced chemical or physical filtering processes that selectively separate out lithium ions. While DLE has yet to take off, its reduced need for water and land has made it a prime focus for companies and governments looking to ramp up production to meet the growing demand for lithium as electric vehicles take off and even bigger batteries are increasingly used to back up power grids. China, which processes more than two-thirds of the world’s mined lithium, is developing its own DLE to increase domestic production of the raw material. New approaches are still being researched, but nearly a dozen companies are actively looking to commercialize DLE technology now, and some industrial giants already offer basic off-the-shelf hardware.

In August, Lilac completed its most advanced test yet of its technology, which the company says doesn’t just require far less water than traditional lithium extraction—it uses a fraction of what other DLE approaches demand.

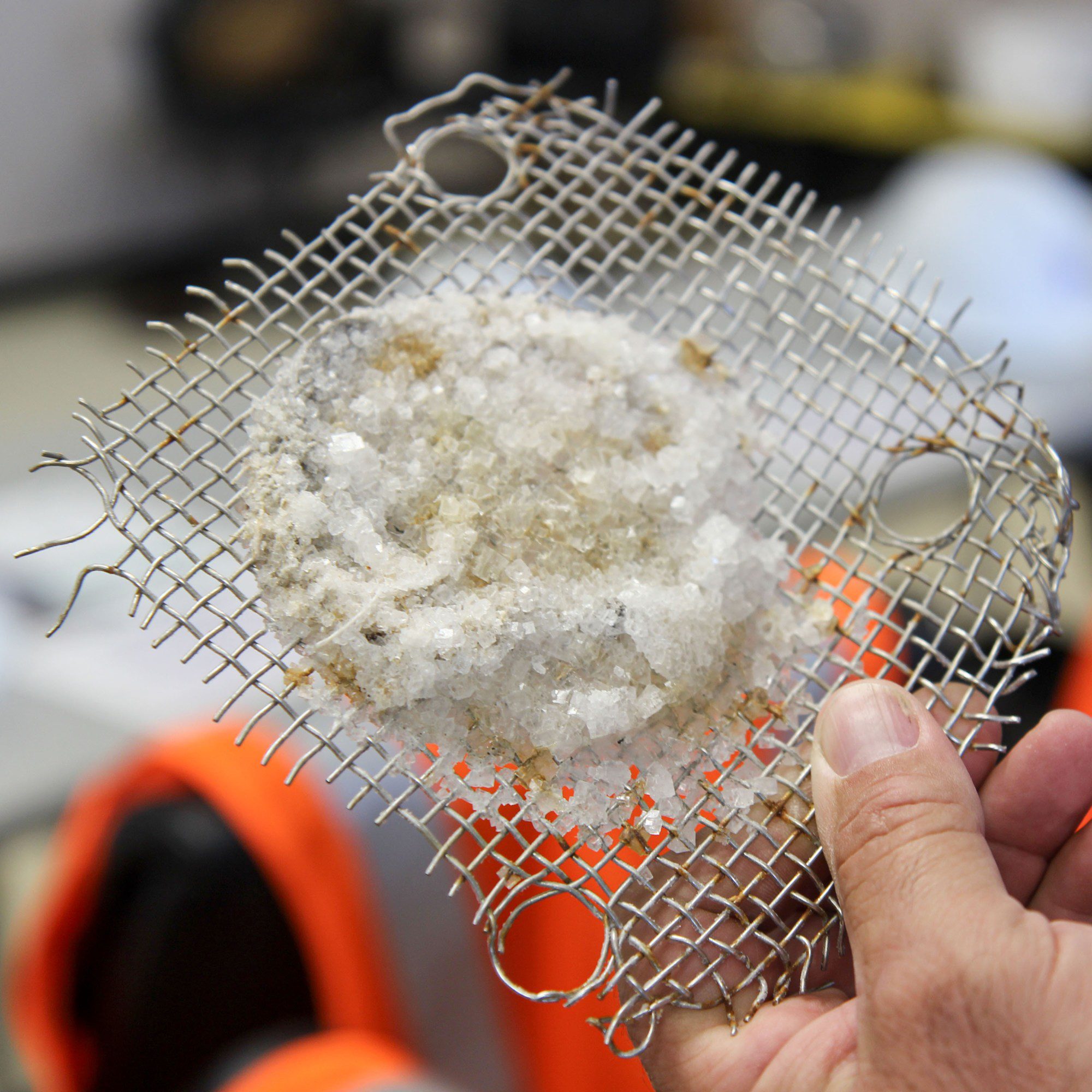

The company uses proprietary beads to draw lithium ions from water and says its process can extract lithium using a tenth as much water as the alumina sorbent technology that dominates the DLE industry. Lilac also highlights its all-American supply chain. Technology originally developed by Koch Industries, for example, uses some Chinese-made components. Lilac’s beads are manufactured at the company’s plant in Nevada.

Lilac says the beads are particularly well suited to extracting lithium where concentrations are low. That doesn’t mean they could be deployed just anywhere—there won’t be lithium extraction on the Hudson River anytime soon. But Lilac’s tech could offer significant advantages over what’s currently on the market. And forgoing plans to become a major producer itself could enable the company to seize a decent slice of global production by appealing to lithium miners companies looking for the best equipment, says Milo McBride, a researcher at the Carnegie Endowment for International Peace who authored a recent report on DLE.

If everything pans out, the pilot plant Lilac builds next to prove its technology at commercial scale could significantly increase domestic supply at a moment when the nation’s largest proposed lithium project, the controversial hard-rock Thacker Pass mine in Nevada, has faced fresh uncertainty. At the beginning of October, the Trump administration renegotiated a federal loan worth more than $2 billion to secure a 5% ownership stake for the US government.

Despite bipartisan government support, the prospect of opening a deep gash in an unspoiled stretch of Nevada landscape has drawn fierce opposition from conservationists and lawsuits from ranchers and Native American tribes who say the Thacker Pass project would destroy the underground freshwater reservoirs on which they depend. Water shortages in the parched West have also made it difficult to plan on using additional evaporation ponds, the other traditional way of extracting lithium.

Lilac is not the only company in the US pushing for DLE. In California’s Salton Sea, developers such as EnergySource Minerals are looking to build a geothermal power plant to power a DLE facility pulling lithium from the inland desert lake. And energy giants such as Exxon Mobil, Chevron, and Occidental Petroleum are racing to develop an area in southwestern Arkansas called the Smackover region, where researchers with the US Geological Survey have found as much as 19 million metric tons of untapped lithium in salty underground water. In between, both geographically and strategically, is Lilac: It’s looking to develop new technology like the California companies but sell its hardware to the energy giants in Arkansas.

The Great Salt Lake isn’t an obvious place to develop a lithium mine. The Salton Sea boasts lithium concentrations of just under 200 parts per million. Argentina, where Lilac has another test facility, has resources of above 700 parts per million.

Here on the Great Salt Lake? “It’s 70 parts per million,” Raef Sully, Lilac’s Australia-born chief executive, tells me. “So if you had a football stadium with 45,000 seats, this would be three people.”

For Lilac, this is actually a feature of the location. “It’s a very, very good demonstration of the capability of our technology,” Sully says. Showing that Lilac’s hardware can extract lithium at high purity levels from a brine with low concentration, he says, proves its versatility. That wasn’t the reason Lilac selected the site, though. “Utah is a mining friendly state,” says Elizabeth Pond, the vice president of communications. And though the lake water has low concentrations of lithium, extracting the brine simply calls for running a hose into the water, whereas other locations would require digging a well at great cost.

When I accompanied Sully to the test site during my tour, our route following unpaved county roads lined with fields of wild sunflowers. The facility itself is little more than an assortment of converted shipping containers and two mobile trailers, one to serve as the main office and the other as a field laboratory to test samples. It’s off the grid, relying on diesel generators that the company says will be replaced with propane units once this location is converted to a permanent facility but could eventually be swapped for geothermal technology tapping into a hot rock resource located nearby. (Solar panels, Sully clarifies, couldn’t supply the 24-7 power supply the facility will need.) But it depends on its connection to the Great Salt Lake via that lengthy hose.

Pumped uphill, the lake water passes through a series of filters to remove solids until it ends up in a vessel filled with the company’s specially designed ceramic beads, made from a patented material that attracts lithium ions from the water. Once saturated, the beads are put through an acid wash to remove the lithium. The remaining brine is then repeatedly tested and, once deemed safe to release back into the lake, pumped back down to the shore through an outgoing tube in the hose. The lithium solution, meanwhile, is stockpiled in tanks on site before shipping off to a processing plant to be turned into battery-grade lithium carbonate, which is a white powder.

“As a technology provider in the long term, if we’re going to have decades of lithium demand, they want to position their technology as something that can tap a bunch of markets,” McBride says. “To have a technology that can potentially economically recover different types of resources in different types of environments is an enticing proposition.”

This testing ground won’t stay this way for long. During my visit, Lilac’s crew was starting to pack up the location after completing its demonstration testing. The results the company shared exclusively with me suggest a smashing success, particularly for such low-grade brine with numerous impurities: Lilac’s equipment recovered 87% of the available lithium, on average, with a purity rate of 99.97%.

The next step will be to clear the area to make way for construction of Lilac’s first permanent commercial facility at the same site. To meet the stipulations of Utah state permits for the new plant, the company had to cease all operations at the demonstration project. If everything goes according to plan, Lilac’s first US facility will begin commercial production in the second half of 2027. The company has lined up about two-thirds of its funding for the project. That could make the plant the first new commercial source of lithium in the US to come online in years, and the first DLE facility ever.

Once it’s fully online, the project should produce 5,000 tons per year—doubling annual US production of lithium. But a full-scale plant using Lilac’s technology would produce between three and five times that amount.

There are some potential snags. Utah regulators this year started cracking down on mineral companies pumping water from the Great Salt Lake, which is shrinking amid worsening droughts. (Lilac says it’s largely immune to the restrictions since it returns the water to the lake.) While the relatively low concentrations of lithium in the water make for a good test case, full-scale commercial production would likely prove far more economical in a place with more of the metal.

“The Great Salt Lake is probably the worst possible place to be doing this, because there are real challenges around pulling water from the lake,” says Ashley Zumwalt-Forbes, a mining engineer who previously served as the deputy director of battery minerals at the Department of Energy. “But if it’s just being used as a trial for the technology, that makes sense.”

What makes Lilac stand out among its peers is that it has no plans to design and manufacture its own DLE equipment and produce actual lithium. Lilac wants instead to sell its technology to others. The pilot plant is just intended to test and debut its hardware. Sully tells me it’s being built under a separate limited-liability corporation to make a potential sale easier if it’s successful.

It’s an unusual play in the lithium industry. Once most companies see success with their technology, “they go crazy and think they can vertically integrate and at the same time be a miner and an energy producer,” Kwasi Ampofo, the head of minerals and metals at the energy consultancy BloombergNEF, tells me.

“Lilac is trying to be a technology vendor,” he says. “I wonder why a lot more people aren’t choosing that route.”

If things work out the right way, Sully says, Lilac could become the vendor of choice to projects like the oil-backed sites in the Smackover and beyond.

“We think our technology is the next generation,” he says. “And if we end up working with an Exxon or a Chevron or a Rio Tinto, we want to be the DLE technology provider in their lithium project.”