Abandoned Carts Are an Opportunity

Abandoned cart recovery can be a goldmine for ecommerce marketers, but not how one might think.

In 2024, ecommerce shopping cart abandonment rates among U.S. adults hover around 70%, according to the Baymard Institute. It’s a big opportunity.

Baymard suggests focusing on design, noting that “if we focus only on checkout usability issues which we…have documented to be solvable, the average large-sized ecommerce site can gain a 35% increase in conversion rate though better checkout design.”

For the overall U.S. and E.U. ecommerce industry, that 35% increase is about $260 billion in additional revenue.

Beyond Design

The problem is that usability and design haven’t solved abandonment thus far. Ecommerce cart abandonment rates have been essentially flat since 2018 and have risen since 2006.

Ecommerce managers have been unable to solve the shopping cart abandonment problem, or the rate does not have the impact on sales we think it might.

What if shopping cart abandonment is normal for ecommerce, and the real opportunity rests in treating folks who abandon carts like warm leads instead of lost opportunities?

That does not mean that online merchants should ignore design or conversion optimization; rather, it implies an opportunity to market to shoppers who didn’t complete the checkout process.

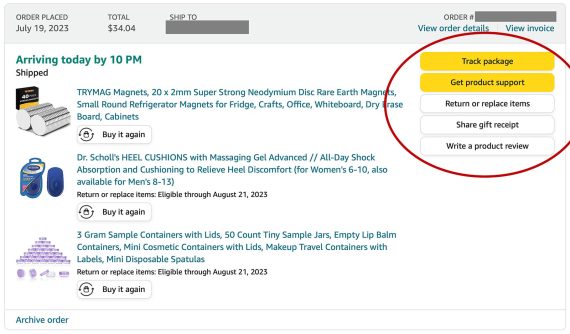

Cart Recovery Email

A cart abandonment email sequence is perhaps the most popular and effective way to recover the sale. Ecommerce platforms such as Shopify and BigCommerce include those emails as default features.

Familiarity, however, may be a problem. It may be too easy to turn on the feature without optimizing it. A better practice could be identifying the shopper as early as possible and creating an automated behavior-based email to convert.

The steps could be:

- Capture the shopper’s email address as soon as possible,

- Understand when to send the first cart recovery email message,

- Know how many messages the series should include,

- Optimize and personalize the message content.

Merchants should test and optimize each step for their audience and setup. For example, some marketers send the first recovery email 90 minutes after the abandonment, but others prefer 30 minutes or less.

Retargeting Ads

Another recovery tactic is to retarget cart abandoners with advertising. Retargeting ads should complement the abandonment email series. When the series begins, it should add the shopper to a retargeting campaign. This requires automation to launch a retargeting campaign and then turn it off.

The campaign should run on Google and Meta and in programmatic email via services such as LiveIntent. The goal is to remind shoppers of the abandoned items.

As always, testing and iterating is the key to remarketing success.

Text Messages

After email, the most powerful ecommerce communication tool is text messaging. Text messages are now the preferred transactional communication channel for many shoppers.

A typical online buyer prefers text-based order and shipping notifications. Marketers can use that affinity to remind shoppers via text about abandoned items. Make the message as transactional as possible and avoid repeated messages.

Better Recovery

Since 2006, ecommerce cart abandonment rates have risen from about 59% to 70%, peaking at almost 72% in 2012 with the rise of smartphones before leveling off.

Yet cart abandonment is an opportunity. Without neglecting design, merchants can improve their recovery efforts with coordinated email, retargeting ads, and text messages.