Turn Shoppers into Brand Advocates

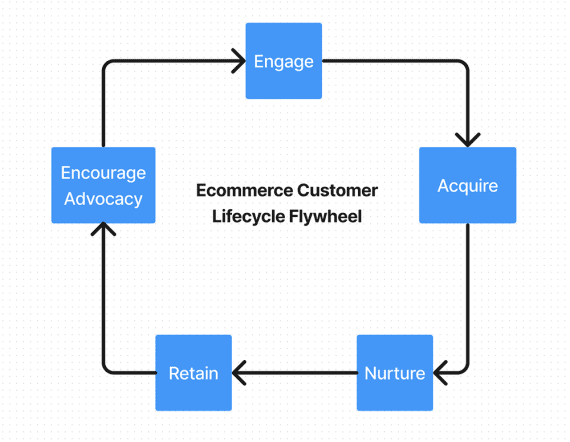

Turning shoppers into brand advocates transforms the customer lifecycle into a profit-generating flywheel.

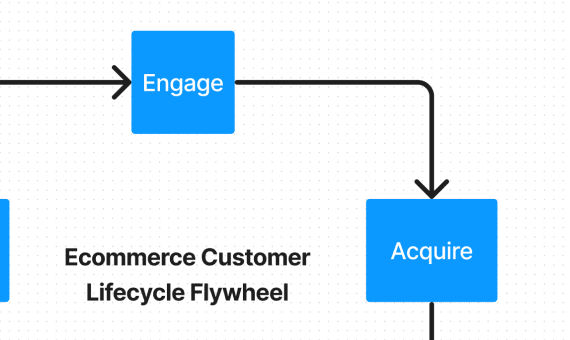

An ecommerce customer lifecycle is a process with steps. It’s different from a flywheel, a model of continuous improvement. Combined, they create a reinforcing loop that produces customers and revenue.

A customer lifecycle flywheel drives sales in a loop that improves with every rotation.

Ecommerce Customer Lifecycle

A customer lifecycle generally has five broad steps — from discovering a brand or product to becoming an advocate for the business.

Ecommerce marketers often focus on one or two of these steps. For example, some marketers spend most of their time engaging and acquiring shoppers. This is essential work but unending.

Marketers relying on advertising to engage customers will never eliminate paid acquisition or reduce its cost. Growth will be proportional to investment.

In contrast, the same marketers could develop brand advocates and soon find steps one (Engage) and two (Acquire) filled with referred shoppers.

By no means should ecommerce stores stop advertising. But they should think of customer lifecycles as flywheels.

Connecting Stages

Business flywheels have rules. First, the virtuous cycle means each flywheel step moves smoothly to the next. For example, many marketing teams are good at moving shoppers from engagement (Engage) to purchase (Acquire).

Each step in a business flywheel should flow smoothly into the next.

A prospect moves from the Engage step to Acquire when she has enough context to make a purchase. Ecommerce marketing teams are usually very good at this part of the wheel. They run ads, monitor clicks and visitors, and measure conversions.

Moving a shopper from Acquire to Nurture should be just as smooth. Perhaps this requires a post-purchase email sequence encouraging the shopper to join a newsletter. Or it may be a thank-you note from the store.

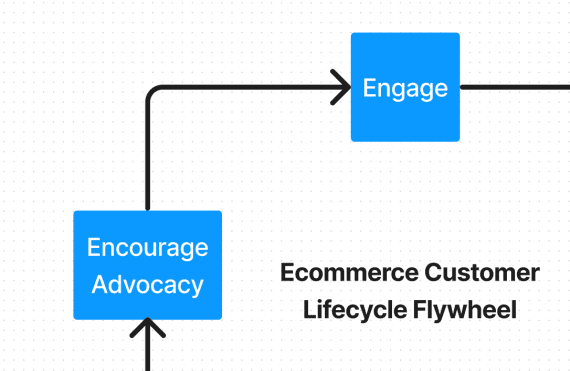

Each step should lead to the next. Encourage Advocacy becomes the final step, leading back to Engage. The store’s advocates have become marketers, exposing potential customers to the business. Thus Engage now includes both referred and purchased shoppers.

Encourage Advocacy, the last step in a business flywheel, restarts the cycle.

Ease

The second rule of a business flywheel is each rotation is easier. This becomes true when marketers focus on the entire cycle and encourage advocacy.

Here is a hypothetical example. What if every brand advocate produced one prospect for each rotation of the flywheel? Assuming the company ordinarily obtains 100 engaged shoppers each cycle, advocacy could lead to 47 more engaged shoppers by the fifth rotation.

With brand advocates, the top of the cycle (Engage) is growing because customers beget customers.

Effectiveness

The third rule for a business flywheel is each rotation is more effective.

This, too, is true when marketers consider the entire lifecycle.

In the example above, more prospects are entering the Engage step, and thus more into Acquire, Nurture, Retain, and Encourage Advocacy.

Flywheel

A linear conversion process implies an ending. Marketers often focus on the steps that conclude with immediate sales. But transform that process into a flywheel, and suddenly advocacy is not the end but the beginning of greater opportunity.

Develop promotional tactics for each step in the cycle. The increased flow boosts revenue and profit without more investment.