How to Scale a Recommerce Business

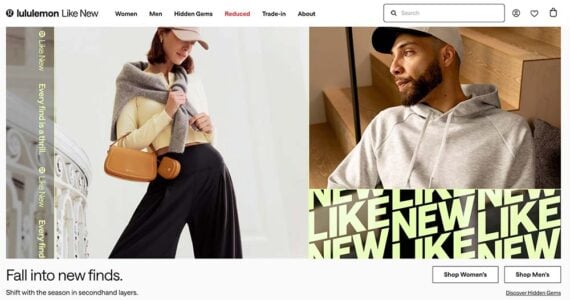

The idea of selling used or overstock goods is not new. Secondhand and thrift shopping is as old as commerce itself.

What has changed is resale volume and the operational challenges that have emerged. Shops that want to sell used, refurbished, and overstock items should establish repeatable systems for handling sourcing, intake, authentication, grading, and pricing.

Repeatable Recommerce

Sourcing

The initial challenge is consistently finding desirable goods.

The aim is predictable systems for procuring products that turn over quickly and profitably.

- Returns as inventory. Don’t overlook returned items. They are a reliable source of secondhand stock.

- Customer trade-ins. Buy-back programs also provide a predictable supply of inventory and encourage repeat purchases. Merchants can let shoppers trade in and trade up apparel, outdoor gear, electronics, and luxury accessories. Carefully define what your business accepts and how credit is issued.

- Liquidation sourcing. Platforms such as B-Stock, Bulq, and Liquidation.com offer bulk pallets from major retailers. The condition varies widely, often with incomplete manifests. Nonetheless, pallet sourcing remains a low-cost way to learn recommerce, especially in apparel and home goods.

- Partnerships. Finally, many secondhand ecommerce businesses develop sourcing partnerships with manufacturers or other retailers to purchase clearance, end-of-season, or returned goods.

Intake

In circular commerce, intake drives goods toward a sale.

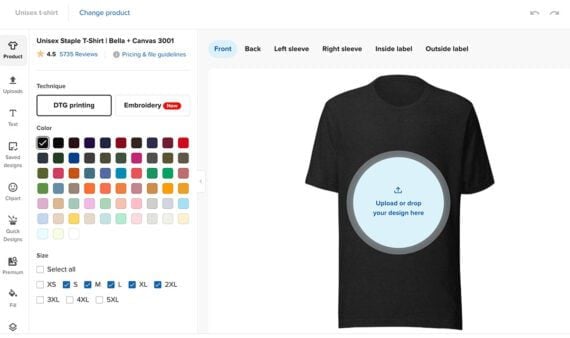

An effective intake workflow should move every item through a repeatable process, to:

- Identify,

- Clean,

- Measure or test,

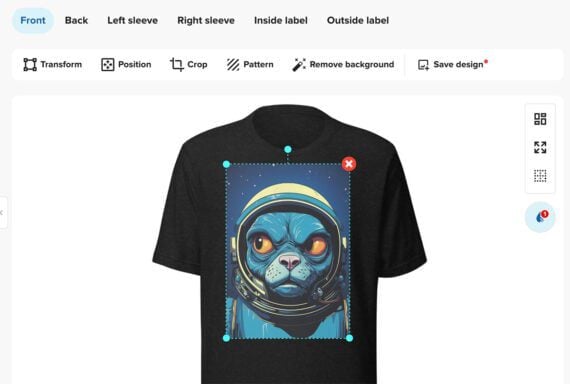

- Document condition,

- Photograph,

- Authenticate,

- Assign a grade,

- List.

Each step is an opportunity to reduce the time from sourcing to sale. The better the intake process, the better the cash flow.

While each of these tasks is essential, the last three require extra attention.

Authenticate

Some categories of secondhand products require authentication or certification.

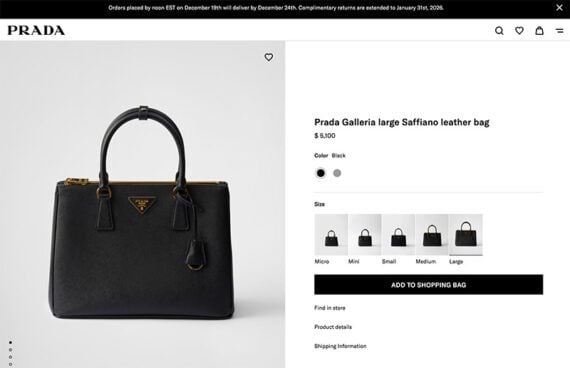

For example, a shop that lists a large Prada Galleria bag (which sells new in 2025 for $5,100) had better ensure it’s a genuine Prada. Counterfeits can kill a recommerce business.

Services such as Entrupy, Certilogo, and category-specific verification tools can help. In most cases, submitting photographs will be enough to authenticate an item.

A buyer for a used Prada bag seeks quality and brand recognition.

Grading

Recommerce grading can take two forms.

First, the description for every item should address its condition. Grading could be as simple as “like new” or “fair.” For such subjective grades, try to have a repeatable standard. For example, apparel with stitching needs can only be labeled “fair.”

Mistake in grading — too much or too little — erodes trust.

A second form of grading applies to collectible goods. Books, for example, often have grades such as “mint,” “fine,” and “near fine,” each with a specific definition.

When products have a standard and accepted grading system, use it.

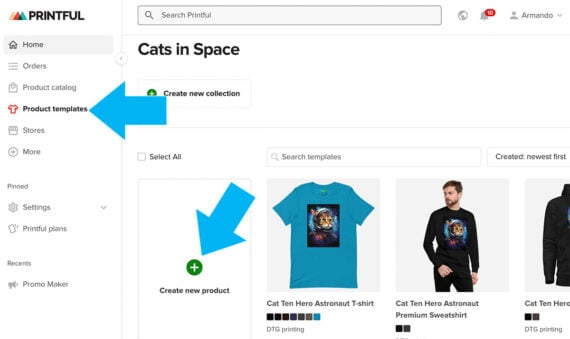

Listing

Where to list — offer or sale — a secondhand, refurbished, or overstock item requires market awareness and understanding, and a bit of skill.

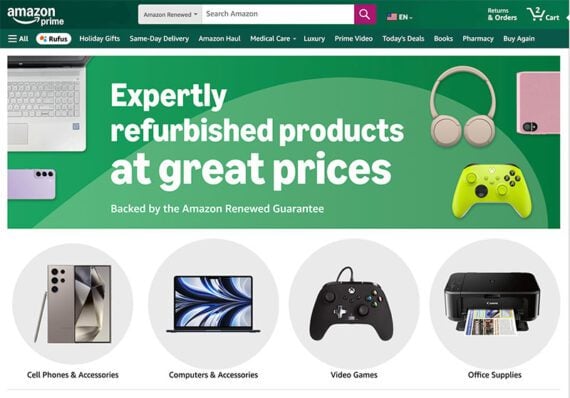

The listing should be priced competitively for a given market. A refurbished Xbox juxtaposed with a new one on a retailer’s website may sell at a higher price than on Facebook Marketplace or eBay.

The price difference among markets should not discourage a seller from listing on all or many of them. Instead, it implies the need to use different listing strategies, each emphasizing different features or values.

Product descriptions on Amazon Renewed might focus on the expert refurbishing or like-new performance, while apparel listings on ThreadUp could stress environmental sustainability.

An Amazon Renew shopper likely differs from one on Threadup focused on environmental sustainability.

Recommerce Success

Recommerce can supplement a retailer’s primary sales channel by extracting value from returns, trade-ups, and overstock inventory.

It can also become a standalone business model, where merchants buy and sell across multiple marketplaces.

Success in either model depends on processes and workflows. Shops that standardize intake, grading, authentication, and listing practices earn consumer trust, resulting in faster turnover and lower returns.