Why Marketplaces Block AI Shopping Agents

Autonomous AI shopping agents are moving quickly from novelty to reality, with both financial and legal implications.

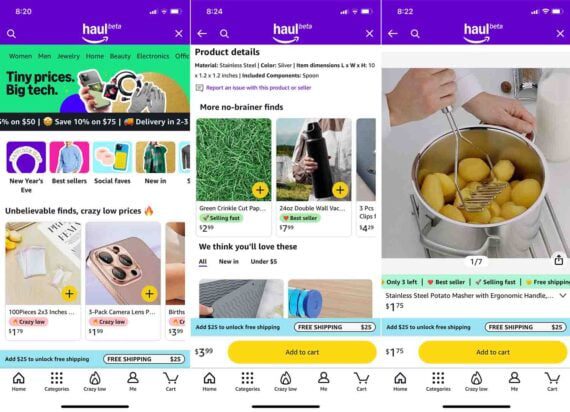

AI-first browsers such as Perplexity’s Comet and OpenAI’s Atlas can now search, compare, and initiate purchases with minimal human involvement.

That process, called agentic commerce, creates faster shopping for consumers and fewer clicks for merchants. It also challenges many ecommerce conventions, including the role marketplaces play in product discovery, transactions, and advertising.

Amazon and eBay have responded. Both are moving to restrict independent AI agents from completing purchases, citing security and user experience concerns. Yet in reality, the fight is almost certainly about control.

AI shopping agents threaten marketplaces such as eBay, Amazon, AliExpress, and many others.

Amazon vs. Perplexity

In November 2025, Amazon sued Perplexity, alleging that the Comet web browser masquerades as a human, accesses Amazon accounts, and places orders in violation of Amazon’s terms of service and computer fraud laws.

Third-party bots, according to Amazon, must operate openly and only with platform permission.

Perplexity countered that Comet acts on behalf of a human, with credentials stored locally for security, and suggested Amazon’s action was an attempt to protect its ad-driven business model and preserve control over shopping flows.

Essentially, Perplexity asks whether a platform can say no if a human authorizes an AI to shop.

eBay’s Ban

Just this month, eBay updated its user agreement to prohibit, without prior approval, “buy-for-me” agents and end-to-end LLM-driven checkout flows.

eBay positions the change as a safeguard against auction manipulation, fraud, and mistaken orders. The company, however, did leave room for “formally sanctioned” shopping agents, thus opening the door for partnerships that eBay can control.

Marketplace Concerns

Taken together, eBay’s update and Amazon’s lawsuit suggest that marketplaces seek to control agentic commerce relationships.

It makes sense. Marketplaces exist to aggregate and centralize shopping. It is the core service they provide and how they earn revenue. Hence agentic commerce is a threat.

Advertising. For the Amazon marketplace specifically and other marketplaces generally, advertising revenue is likely a chief concern.

According to its 2025 Q3 filing with the Securities and Exchange Commission, Amazon generated $47 billion in “advertising services” revenue in the first nine months of last year.

The company is much more than a product marketplace. It is a publisher, too, offering sponsored listings, recommendation units, and paid placements — all deeply embedded in search results and category pages.

Autonomous agents bypass the ads. Instead of scrolling through sponsored products and recommendations, the AI shopping agent skips to an item and initiates checkout.

First-party data. A related concern is shopper data.

Ecommerce marketplaces observe, track, and use shopper behavioral information. They monitor what shoppers search for, which products they view, and the items they abandon. Those signals feed ranking algorithms, recommendation systems, and personalization models.

That data disappears when an external AI agent performs comparisons and decision-making outside the marketplace, which sees only the final purchase.

Transactions. In its case against Perplexity, Amazon did not dispute that the AI agent completed the transaction via Amazon’s own checkout. Nonetheless, an AI-driven checkout creates at least two concerns.

First, the marketplace has no way to ensure that the transaction was proper. What if the AI agent made an error? What if the price is wrong? Could those errors lead to customer service problems or even increased return rates? Maybe.

Second, upselling becomes presumably impossible when the human shopper never sees it.

Compromise

Yet the developers of AI shopping agents disagree.

Agentic commerce startups argue that shoppers should be free to choose their preferred AI when they interact with services or websites. An AI agent, the argument goes, is more like a browser or an accessibility aid than a competitor.

Per the developers, marketplaces that allow only a few AI partners block human shoppers, stifle innovation, and foster monopolies.

The coming compromise will likely enable marketplaces to approve access within reasonable limits.

Thus AI agents, perhaps even Perplexity’s Comet, will eventually access marketplaces via official APIs, subject to rate limits, identity verification, and possibly commercial arrangements. Think affiliate programs for bots that pay for access.

For small-to-medium ecommerce businesses, the agent-marketplace relationship will likely be a primary route for getting products into Perplexity, ChatGPT, and similar platforms. It could be a key revenue channel.