3 Keys to Successful Products on Amazon

Jake Zaratsian is a content creator at Jungle Scout, the Amazon seller platform. He’s also a part-time brand owner on that marketplace, selling disposable dinnerware plates made from palm leaves. Curious, I asked him, “Why palm plates?”

He cited three reasons: a product with at least 300 monthly sales, a selling price of $20 each, and consumable for repeat buyers. Disposable palm-leaf plates fit the need.

He and I recently spoke. We addressed Jungle Scout’s tools, dos and don’ts for Amazon sellers, and much more. The entire audio of our conversation is embedded below. The transcript is edited for clarity and length.

Eric Bandholz: Give us a quick rundown of who you are and what you do.

Jake Zaratsian: I am a content creator at Jungle Scout, an Amazon seller platform. I also run my own Amazon brand called Natural Events. We sell disposable dinnerware plates made from palm leaves. I consult on the side for a few brands that sell on Amazon.

Bandholz: What’s an excellent product to sell on Amazon?

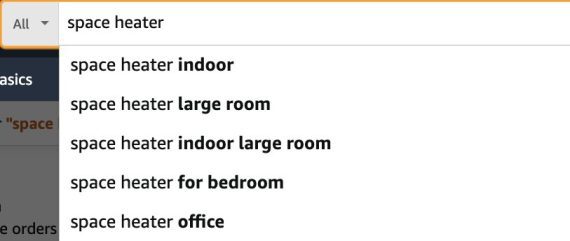

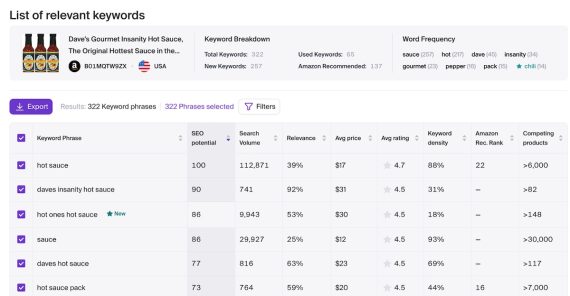

Zaratsian: That’s a good question because it changes so often. The challenge is finding a product that can improve what’s currently available. Advertising is costly. Jungle Scout has an extension that shows what everybody’s selling and the average monthly volume. It’s a starting point for finding product ideas. Start with 10 ideas, and then research the market.

A key factor is standing out on the search results page to win more conversions with less ad spend. Find a product with at least 300 monthly sales and high profit margins — 20% minimum. Then make your product better.

Cobalt, Jungle Scout’s tool for enterprise sellers, offers much more data and some automation tools. It’s easily customized.

Bandholz: Why palm-leaf plates?

Zaratsian: Jungle Scout’s algorithm can project revenue. I wanted to find products on Amazon that had 300 monthly sales. That gave me hundreds of items in the U.S. alone. The next filter was products selling for at least $20.

I also wanted a consumable item that customers would buy repeatedly. I used a Jungle Scout keyword filter for “disposable” in the product title.

The result was a list of products with 300 monthly sales at $20 or more apiece and were disposable.

Bandholz: What’s your advice for merchants considering Amazon?

Zaratsian: Think about how much inventory you send to Amazon and the potential sales volume. Amazon has hefty long-term storage fees that seem to increase continually. They also penalize you for not having enough inventory. Focus on avoiding these long-term storage fees and having inventory sitting in Amazon, especially during Q4.

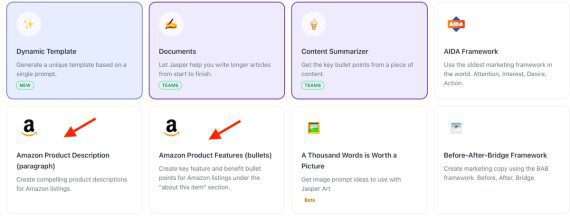

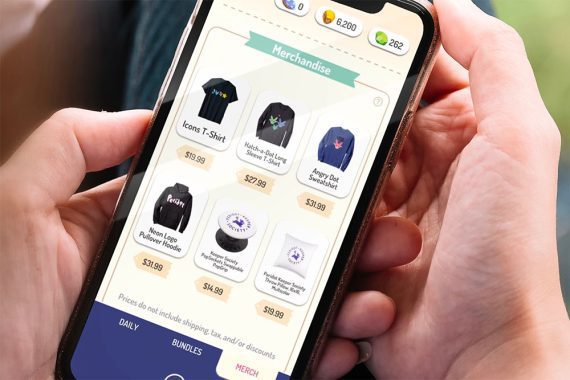

Content is so powerful. Many Amazon sellers are starting to utilize Inspire. It’s Amazon’s version of TikTok, except for folks looking for products to buy. Every photo and video has a product link. That, to me, is an untapped opportunity. Inspire is a low-friction way of getting your product in front of customers.

Building a presence on Amazon is like real estate without buying the property. Granted, it takes a lot of work — product listings and brand building. But you’re creating an asset with value.

Bandholz: Where can people follow you?

Zaratsian: Go to JungleScout.com. I’m on LinkedIn and Instagram.