Data Clean Room: What It Is & Why It Matters In A Cookieless World via @sejournal, @iambenwood

In recent years, the digital marketing landscape has experienced significant shifts, particularly concerning user privacy and data tracking mechanisms.

Notably, Google’s initial plan to phase out third-party cookies in Chrome by 2022 was reversed in July 2024, allowing their continued use.

This reversal has implications for data clean rooms, which were poised to become essential tools in a cookieless world.

However, the persistence of third-party cookies does not diminish the growing challenges associated with signal loss.

Users are increasingly encountering cookie consent pop-ups and more prominent privacy notices across websites and apps, which is reducing the availability of data for marketers.

This heightened user awareness and control over personal data necessitate reevaluating data collection and analysis strategies.

Data clean rooms remain vital in this context. They offer a privacy-compliant environment where multiple parties can collaborate on data without exposing personally identifiable information.

They also enable advertisers and publishers to perform advanced analytics on combined datasets, extracting valuable insights while adhering to privacy regulations.

What Is A Data Clean Room?

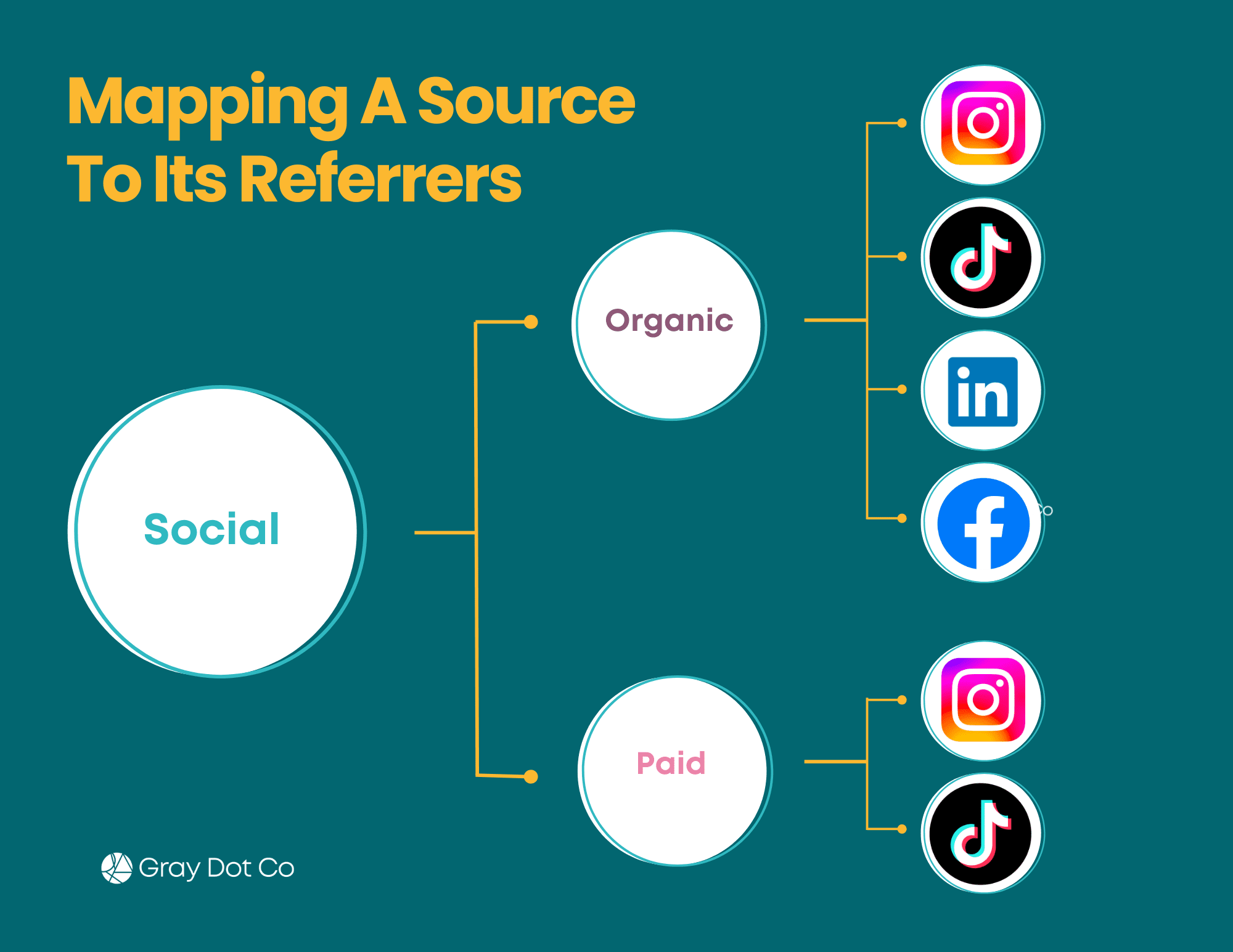

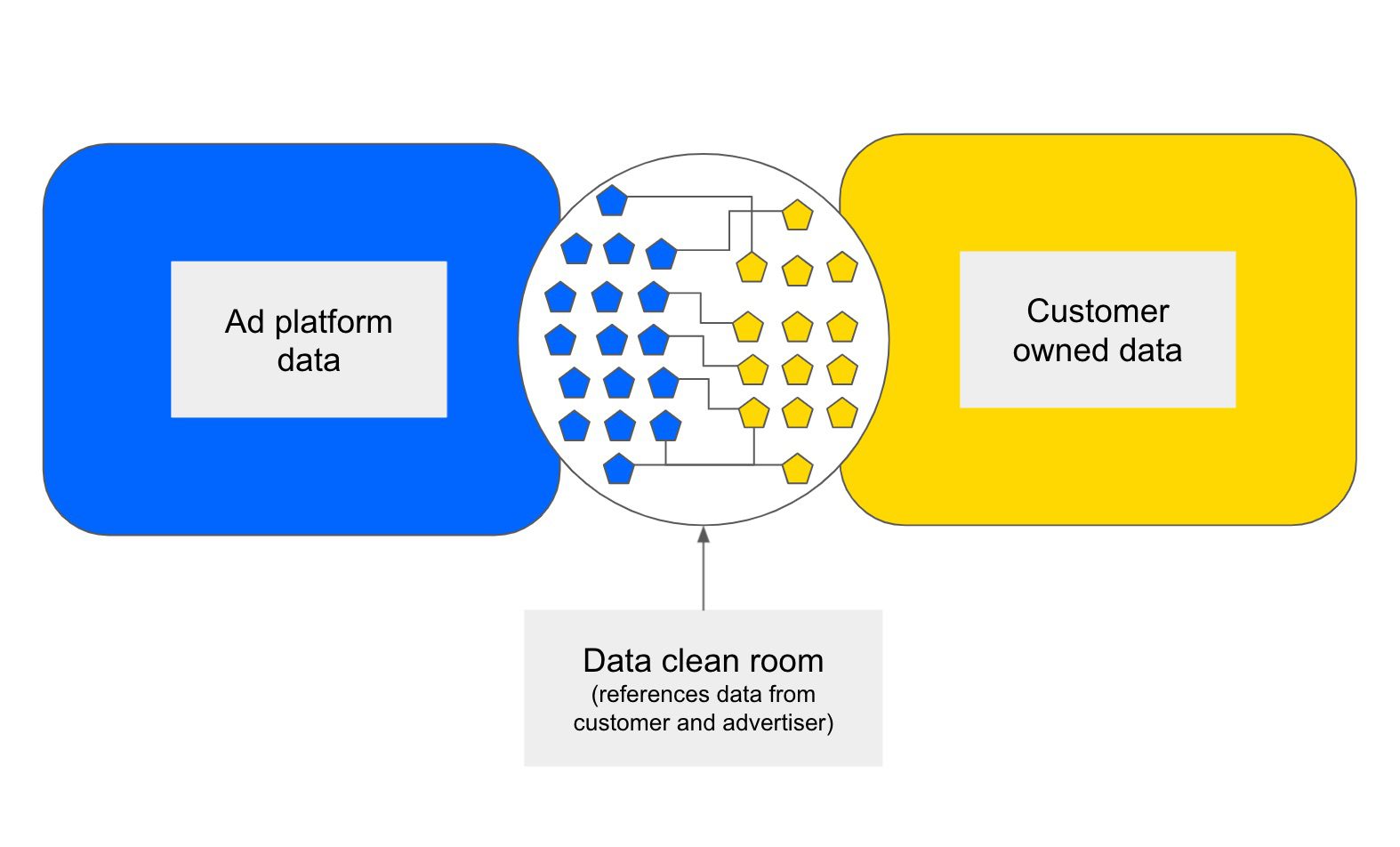

A data clean room is a piece of software that enables advertisers and brands to match user-level data without actually sharing any PII/raw data with one another.

Major advertising platforms like Facebook, Amazon, and Google use data clean rooms to provide advertisers with matched data on the performance of their ads on their platforms.

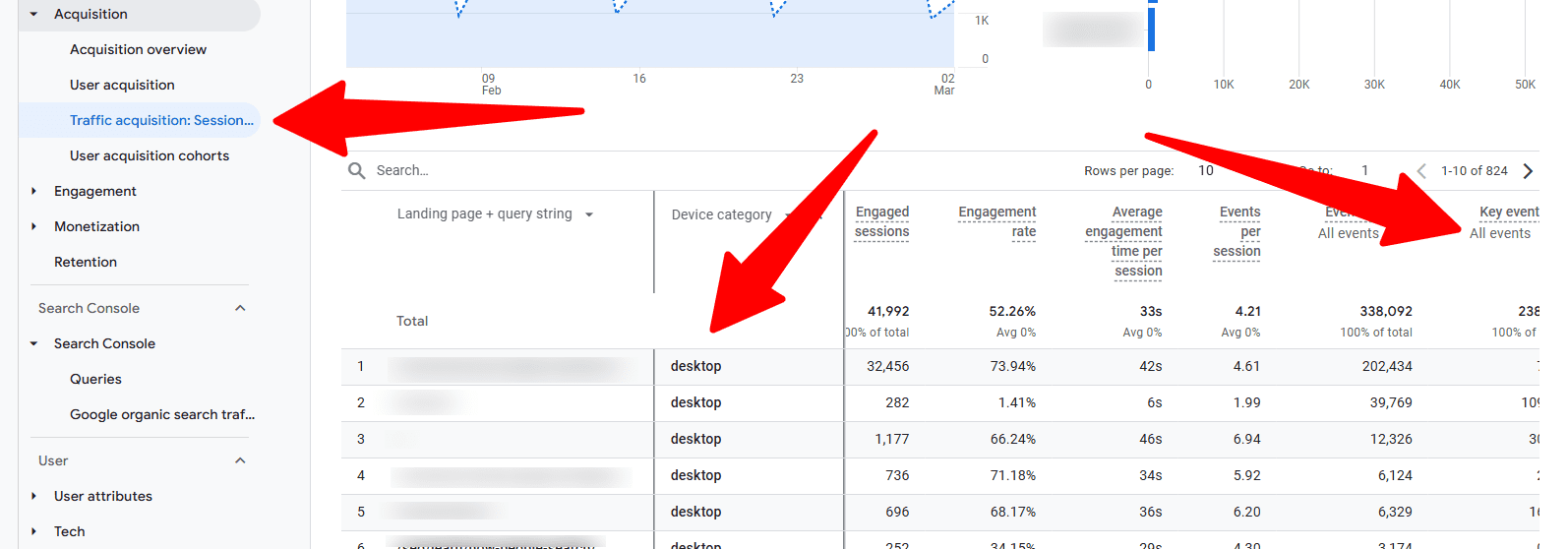

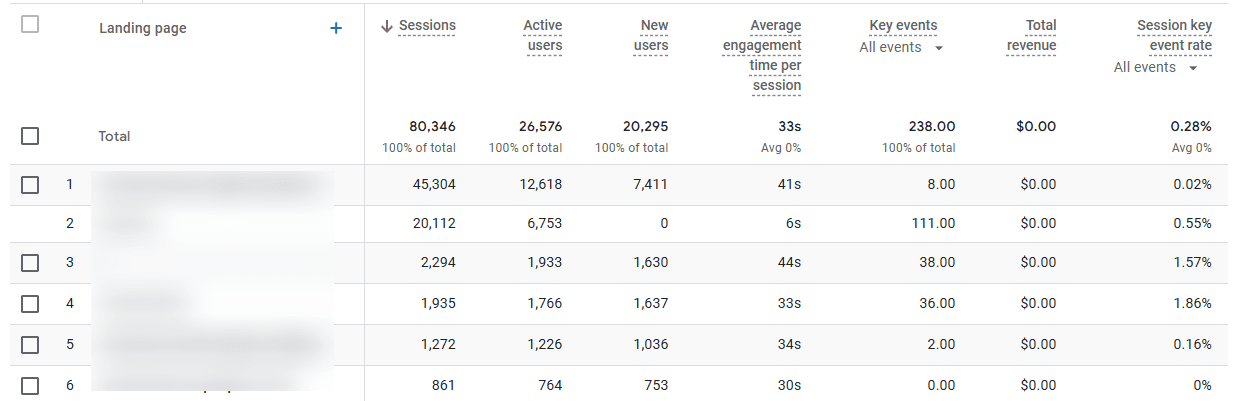

Image from author, March 2025

Image from author, March 2025All data clean rooms have extremely strict privacy controls, and businesses are not allowed to view or pull any customer-level data.

Modern data clean rooms have evolved to facilitate more streamlined and secure data collaboration.

They allow brands and publishers to combine datasets without exposing raw data, adhering to stringent privacy regulations.

This advancement addresses the challenges posed by increased data fragmentation and the heightened emphasis on user privacy.

The benefit to advertisers is a much clearer picture of advertising performance within each platform.

But, it does rely on a solid bank of first-party data in the first place in order to run any significant matching with platform data.

For example, Google’s Ads Data Hub allows you to analyze paid media performance and upload your own first-party data to Google. This allows you to segment your own audiences, analyze reach and frequency, and test different attribution models.

There’s one major issue with this approach.

Although many platforms claim to be able to offer a cross-channel clean room solution, it’s hard to see how this would be the case given the strict privacy controls in place by Google and other platforms.

This is fine if a brand wants to increase spend within each platform, but it still creates a challenge in cross-network attribution.

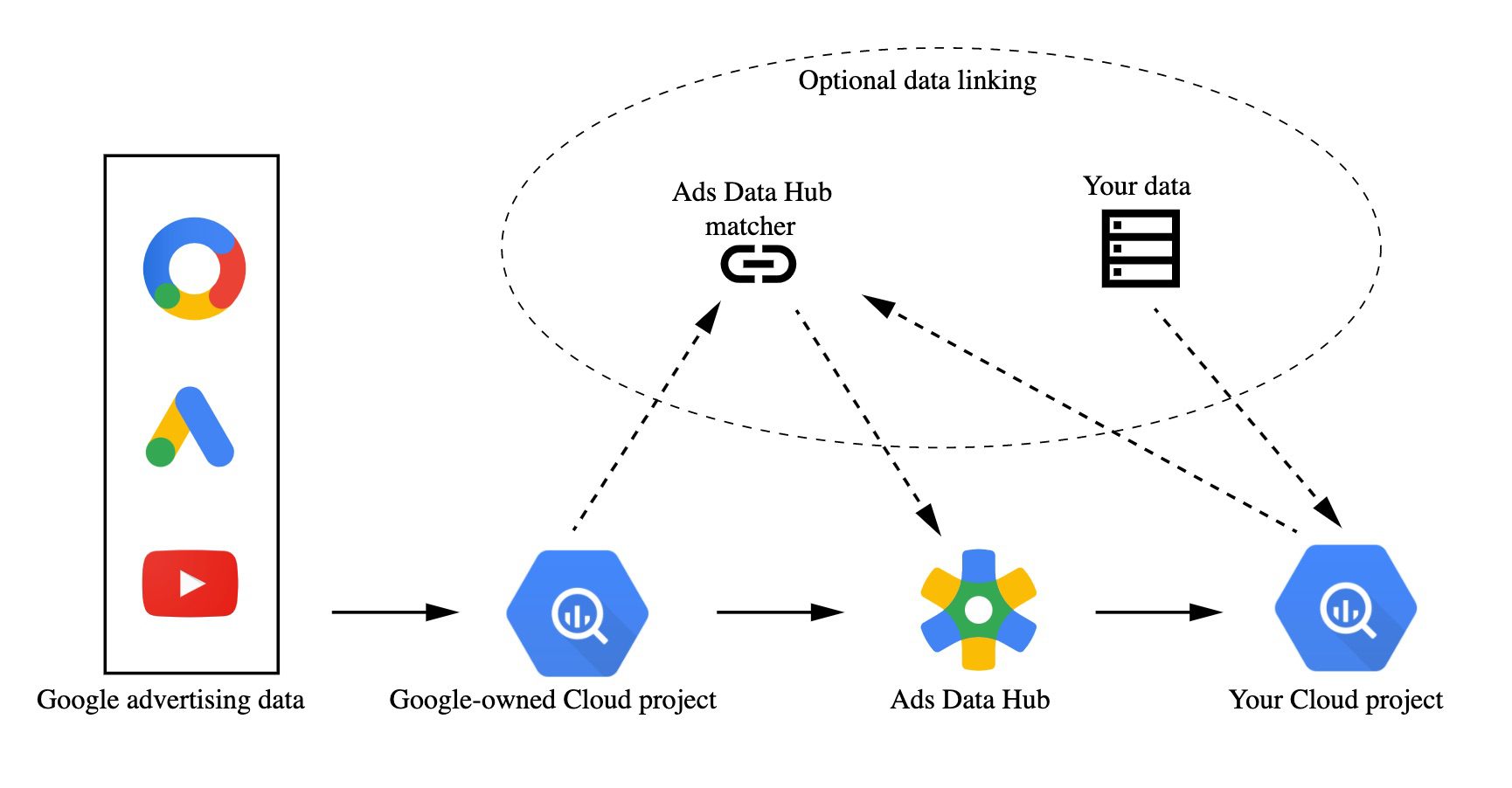

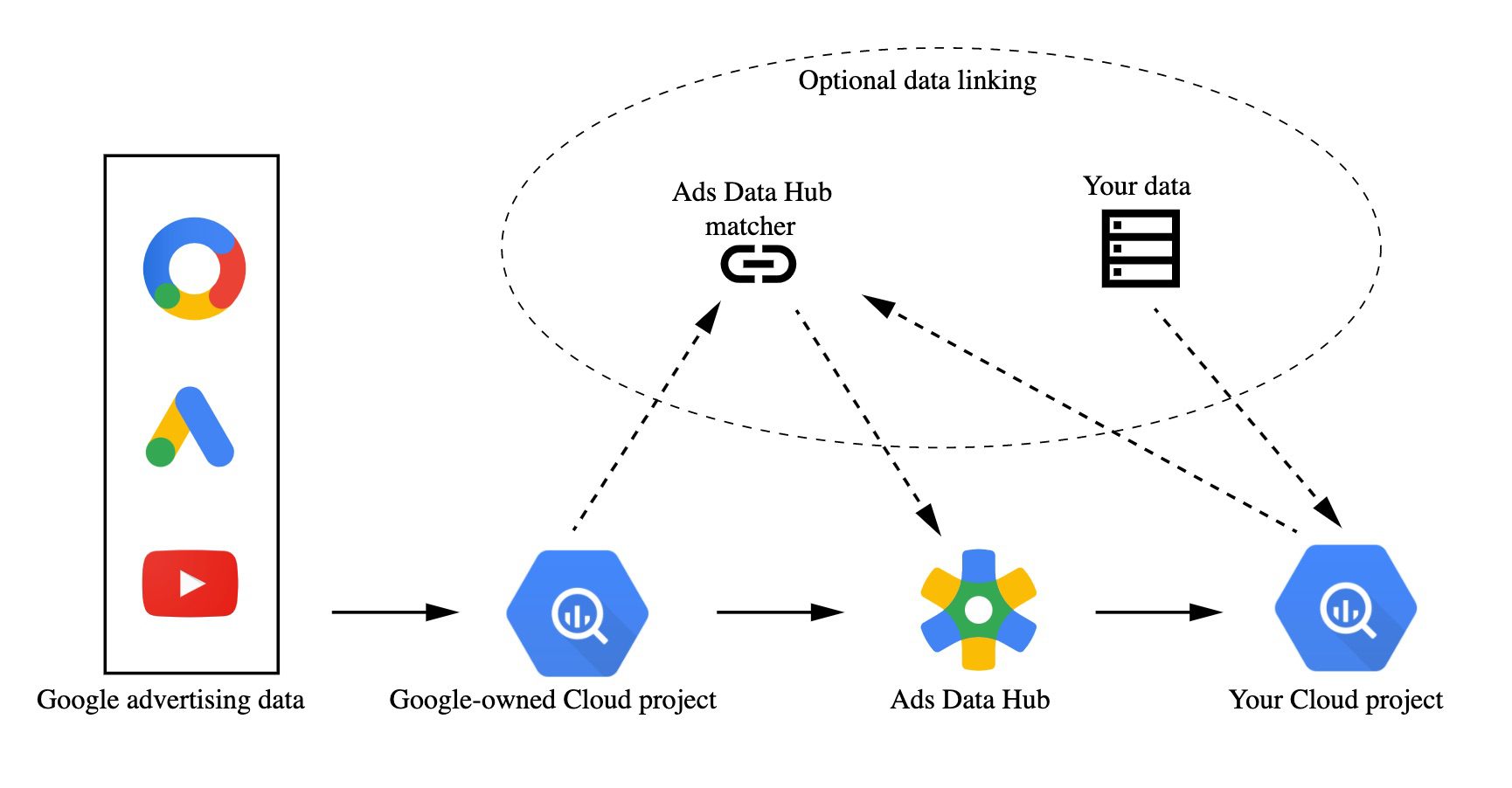

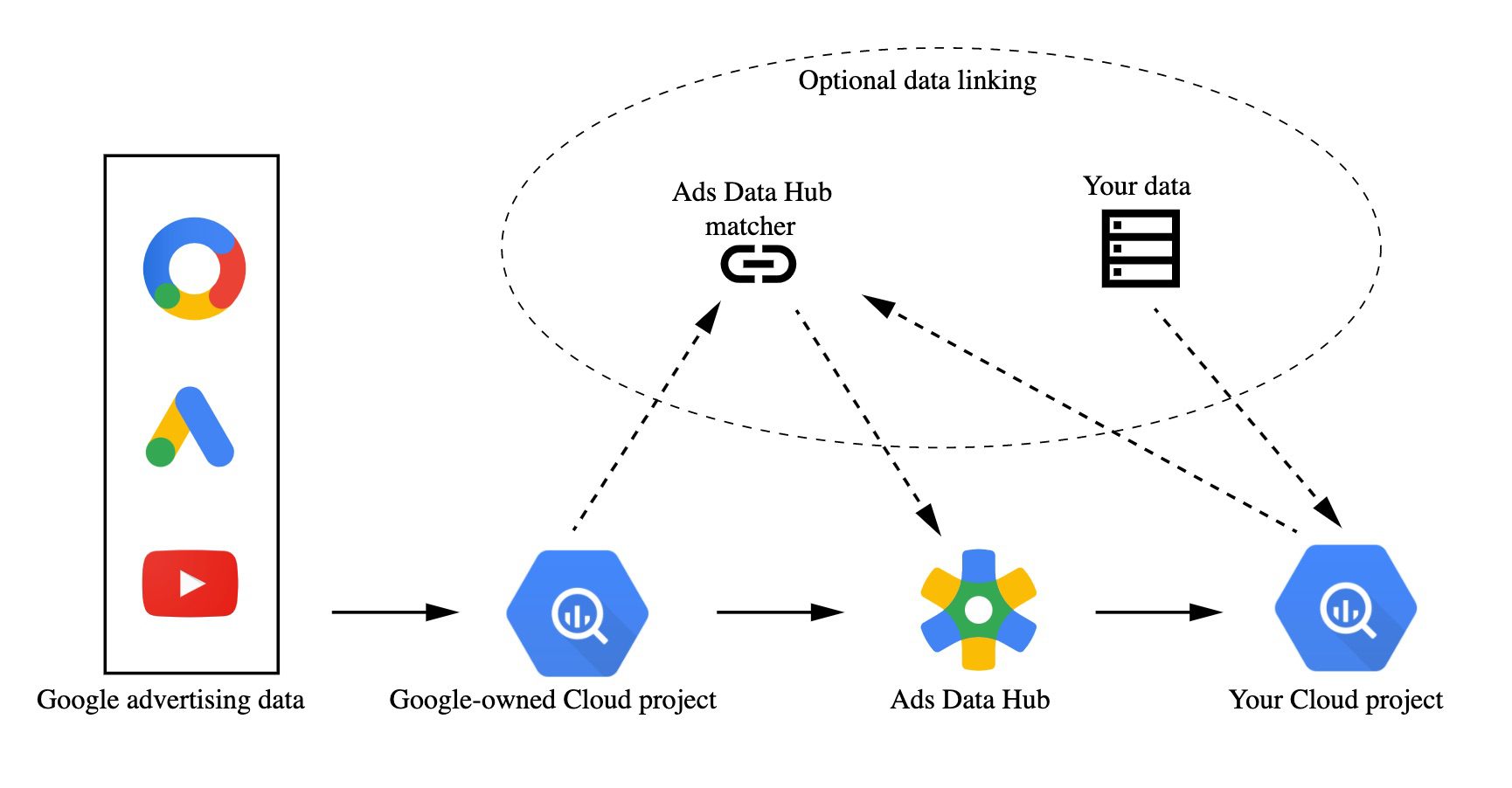

An Example: Google Ads Data Hub

Google’s Ads Data Hub is expected to be a future-proof solution for Google-specific advertising (Search, Display, YouTube, Shopping) measurement, campaign insights, and audience activation.

Ads Data Hub is most effective when running multiple Google platforms, and if you have a substantial amount of first-party data to bring to the party (e.g., CRM data).

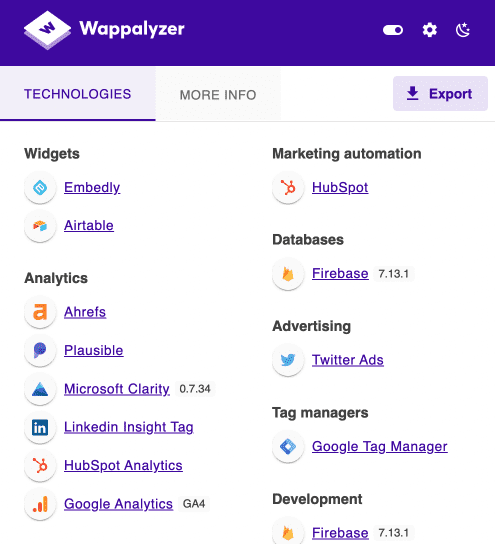

Ads Data Hub is essentially an API. It links two BigQuery projects – your own and Google’s.

The Google project stores log data you can’t get elsewhere because of GDPR rules.

The other project should store all of your marketing performance data (online and offline) from Google Analytics, CRM, or other offline sources.

Data Clean Room Challenges And Limitations

First-party data (the kind used to power data clean rooms) comes with fewer headaches around complying with privacy regulations and managing user consent.

But, first-party data is also much harder to get than third-party cookie data.

This means that the “walled gardens” such as Google, Facebook, and Amazon, which have access to the largest bank of customer data, will benefit from being able to provide advertisers with enhanced measurement solutions.

Also, brands that have access to lots of consumer data – e.g., direct-to-consumer brands – would gain a marketing advantage over brands that have no direct relationships with consumers.

Most data clean rooms today only work for a single platform (e.g., Google or Facebook) and cannot be combined with other data clean rooms.

If you advertise across multiple platforms, you will find this limiting since you cannot join the data to build a full view of the customer journey without manually stitching the insights together.

Before marketers dive into a specific clean room platform, the first consideration should be how much of your ad spend is focused on each network.

For example, if the majority of digital spend is focused on Facebook or other non-Google platforms, then it’s probably not worth investing in exploring Google Ads Data Hub.

Alternatives To Data Clean Rooms

Data clean rooms are just one way of overcoming the challenges we face with the loss of third-party cookies, but there are other solutions.

Two other notable alternatives being discussed right now are:

Browser-Based Tracking

Google claims its Federated Learning of Cohorts (FLoC) inside Chrome is 95% as effective as third-party cookies for ad targeting and measurement.

Essentially, this will hide users’ identities in large, anonymous groups, which many are skeptical about.

To be clear, FLoCs aren’t clean rooms – but they do anonymize user-level data and cluster audiences based on shared attributes.

Universal IDs

Universal user IDs are an alternative to the browser-based tracking option presented in Google’s privacy sandbox.

These would be used across all major ad platforms but anonymized so advertisers wouldn’t see a person’s email address or personal data.

In theory, universal IDs would make cross-network attribution easier for advertisers, as the universal ID tag would effectively replicate the functionality of third-party cookies.

What Will The Future Hold?

Tracking and reporting are no longer background tasks that we used to take for granted; they now require explicit user consent.

This transition requires companies to ask users for their consent to give up their data more often.

It requires users to click through more obtrusive privacy pop-ups. It will probably create more friction for users, at least in the short term, but this is the trade-off for a free and open web.

Beyond the “walled gardens” such as Google, some companies are working to build omnichannel data clean rooms.

These secure environments facilitate collaborative data analysis, enabling marketers to derive actionable insights without compromising user privacy.

In summary

Data clean rooms have become indispensable in navigating the complexities of modern digital marketing.

Their ability to enable secure, privacy-compliant data collaboration positions them as crucial tools in addressing the challenges of data fragmentation and stringent privacy regulations.

While this would certainly help with the challenge of cross-platform attribution, there will likely be a mismatch between the data provided between different ad platforms that will require manual interpretation.

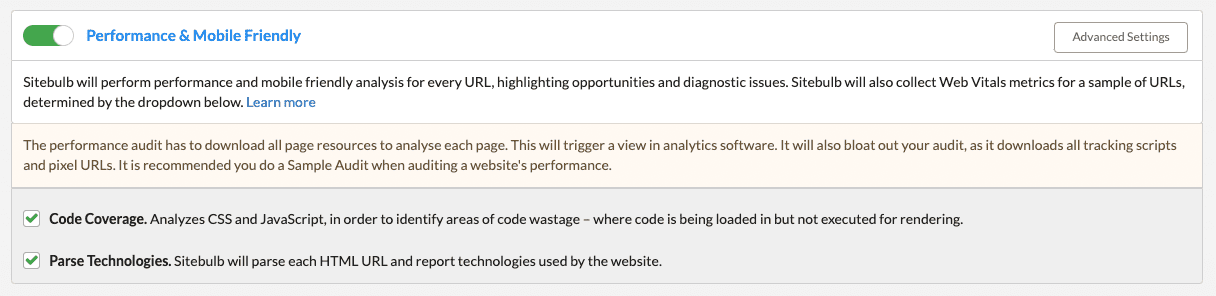

Regardless of the “clean room” technology that will enable this data matching, there is a need to invest in building up your own first-party data now to enable any cross-referencing of data with advertising platforms or ad tech providers.

This requires creating and trading value for deep data on your customers.

More Resources:

Featured Image: Gorodenkoff/Shutterstock