Early AI Signals from Holiday Sales

Traffic from various AI sources to ecommerce shops leapt significantly during the 2025 Christmas season, yet still accounted for a tiny share of actual, direct visits.

Adobe reported a record $257.8 billion in U.S. 2025 online sales from November 1 through December 31, up 6.8% from 2024. The data reflects U.S. merchants on the Adobe Analytics platform, which excludes Amazon and most smaller sellers.

The report provides many holiday highlights. In 2025 mobile commerce drove more than 50% of online sales during the Christmas shopping season for the first time. Buy-now-pay-later loans hit a milestone, reaching $20 billion in online spending, up 9.9%.

Thus given the overall holiday sales activity, why focus on AI at all? The answer is because AI’s impact will likely be massive. Salesforce, for example, reported that AI influenced 20% of U.S. Christmas retail sales in 2025.

Vivek Pandya, lead analyst at Adobe Digital Insights, stated, “This 2025 holiday season, consumers embraced generative AI more than ever as a shopping assistant in their purchasing decisions.”

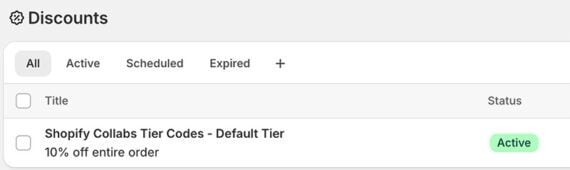

According to Salesforce, AI influenced 20% of U.S. Christmas retail sales in 2025. Image: Salesforce.

The Caveat

Adobe reported a striking 693% increase in AI-driven holiday traffic to ecommerce sites in 2025. But the report does not provide the baseline volume, AI’s share of total referrals, or AI’s share of total revenue.

That omission matters. Growth off a small baseline can produce dramatic percentages. Adobe itself reported a much larger jump — roughly 1,300% — for AI traffic during the 2024 holiday season.

The takeaway is not that AI drove the 2025 holiday season. It did not. But AI-related shopping is rising quickly enough to warrant attention, even if the raw totals remain small for now.

Zero Click Risk

AI’s direct ecommerce value is difficult to quantify today, but merchants can learn from industries where AI discovery is having an impact.

Consider digital publishing. In September 2025, Penske Media — owner of Rolling Stone, Billboard, Variety, and other outlets — sued Google, arguing that AI Overviews used Penske’s content while reducing click-through traffic and revenue. Penske’s affiliate revenue was allegedly down by more than a third from peak levels. Traffic to its websites had halved.

The case highlights a critical shift: AI-driven discovery does not always result in traffic.

In the traditional search pattern, users click links. In AI search, users often get what they need directly on the results page. It is the same “zero-click” dynamic publishers have dealt with for years. AI answers now amplify this impact.

Ecommerce may be heading in a similar direction. Even if AI referrals remain small, AI systems may increasingly influence purchase decisions without always sending shoppers to a retailer’s website.

AI Traffic

AI-driven store visitors may behave differently from shoppers arriving via traditional channels, and Adobe’s holiday data offers a few early clues.

One notable change is device usage. Some 73.4% of AI referrals came from desktop devices, even as mobile accounted for most overall ecommerce transactions.

At least for now, AI chat interfaces and search tools are often more usable on larger screens. Long-form responses, product comparisons, and multi-step research fit naturally into desktop workflows. Consumers may be comfortable researching with AI on a desktop and completing purchases on mobile.

Category patterns reinforce that behavior. AI referrals were most common in product groups where research and comparison matter, such as electronics, toys, appliances, video games, and personal care. These are not necessarily impulse buys. They benefit from explanation, differentiation, and context, all of which are strengths of AI answer engines.

There is also a reasonable theory that AI-referred shoppers are more qualified. A consumer who clicks after querying an AI assistant may have narrowed her choices. But AI interfaces and ads may alter what answer engines recommend, how they compare products, and which merchants appear.

Essentially, AI traffic patterns are still forming, attribution remains murky, and performance may swing quickly. It is worth monitoring, not overreacting.

What to Do

The Adobe and Salesforce data reinforce what many merchants already sense. Product discovery is changing, and AI may become a bigger part of it. Small-to-midsize merchants can respond without betting the business on speculative numbers.

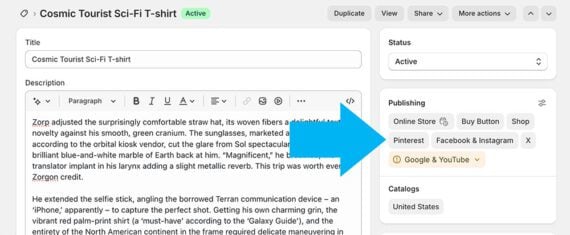

Use platforms. The single best AI-commerce move for many SMB sellers is to use what their ecommerce platforms provide.

Shopify, for example, announced AI discovery integrations that pass structured product data directly to AI systems and support purchases inside chat and AI commerce experiences.

For merchants, that means AI readiness may increasingly be operational: maintain a “clean” product catalog with accurate attributes and structured product data so platforms can access and distribute it properly.

Use marketplaces. Marketplaces will likely become even more important in an AI-mediated shopping environment.

Amazon, Walmart, and similar marketplaces have the data and the scale to integrate AI shopping assistants. Merchants who sell in these channels can expect AI-powered recommendations to amplify the importance of quality product data, accurate inventory, and positive reviews.

Use ads. Paid acquisition has long been a reliable traffic source for online merchants. The reliance could increase in an AI era, particularly if organic discovery becomes less predictable.

Ads are already appearing in AI chat experiences. Merchants can garner at least some AI-driven recommendations and purchases from paid placements, sponsored suggestions, or marketplace advertising.

Measure carefully. AI discovery adds tracking ambiguity. Merchants should ensure analytics capture as much detail as possible in referral sources, landing page engagement, and conversion paths, even if AI traffic is small.

Keep optimizing. Finally, merchants should not give up on optimization.

The goal is to extend traditional search engine optimization techniques to AI. Setting aside the muddy definitions of SEO, GEO (generative engine optimization), and AEO (answer engine optimization), the desired outcome is the same. When shoppers ask, “Which air fryer is best for a family?” or “What toy is right for a seven-year-old?” the stores that provide the best answers for AI will be more likely to appear in the results.

Strong SEO practices carry over well. Clean product catalogs, accurate attributes, structured data, clear descriptions, and buyer-focused content marketing can help AI answer engines and ecommerce platforms understand a store’s goods.

Optimizing for AI commerce, then, is less about chasing new tactics and more about feeding platforms and AI systems better data.