A Mobile Milestone for Christmas 2023

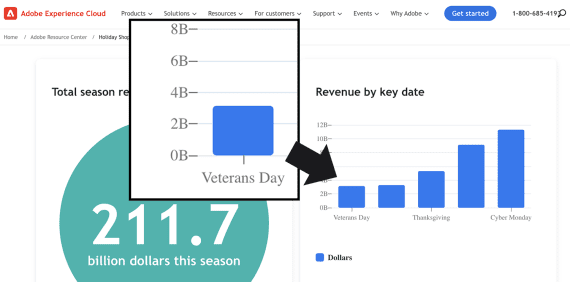

American shoppers dialed up $5.3 billion in 2023 Black Friday smartphone purchases, accounting for 54% of online sales for the day after Thanksgiving, according to Adobe.

Globally, nearly 80% of all online sales occur on a mobile device, per Statista, mainly due to the Asia-Pacific region.

North America generally and the United States specifically have been slower to adopt mobile ecommerce, preferring the more expansive desktop experiences, but that will likely change in 2023 — at least for the Christmas shopping season.

Mobile to Pass Desktop

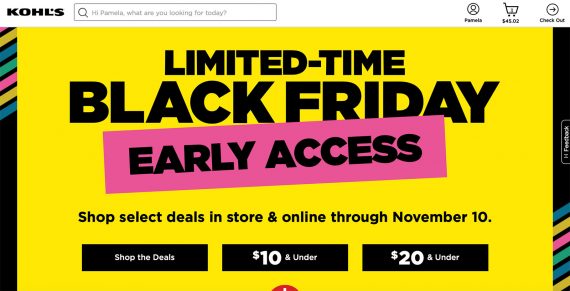

Seemingly everyone will shop on smartphones this 2023 holiday.

Adobe, which tracks holiday ecommerce spending in the United States, “expects mobile to overtake desktop for the first time this holiday season, with more than half (51.2%) of spend online to take place on mobile.”

As evidence, U.S. Black Friday mobile sales grew about 10.4% year-over-year. On Thanksgiving Day, typically even better for mobile ecommerce, shoppers spent $3.3 billion from mobile devices, an increase of 14% compared to 2022.

Mobile Implications

The fact that U.S. shoppers increasingly use smartphones for purchases is not surprising. The surprise is that it took so long. Ecommerce and retail observers have predicted the rise of mobile ecommerce for more than a decade.

Thus it’s a good time to reflect on broader implications for all merchants.

Mobile apps. By some estimates, including data from Sensor Tower, a market intelligence firm, about one in five American adults has downloaded at least one of Amazon’s mobile apps.

Five years ago, Amazon said that 85% of its mobile shoppers used the app versus the website. Assuming the percentage is unchanged, we can see an immediate challenge for small and midsized online sellers.

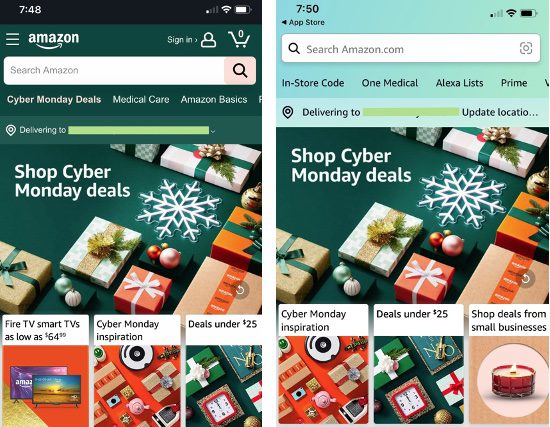

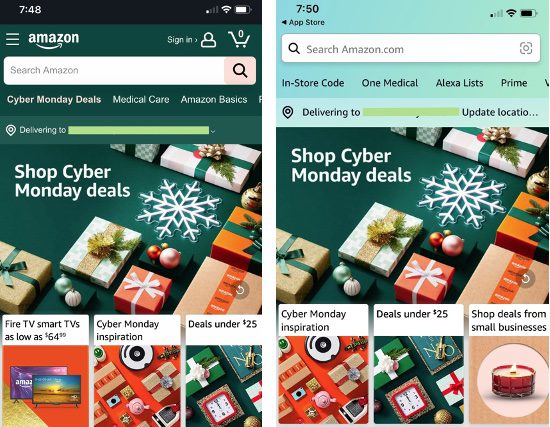

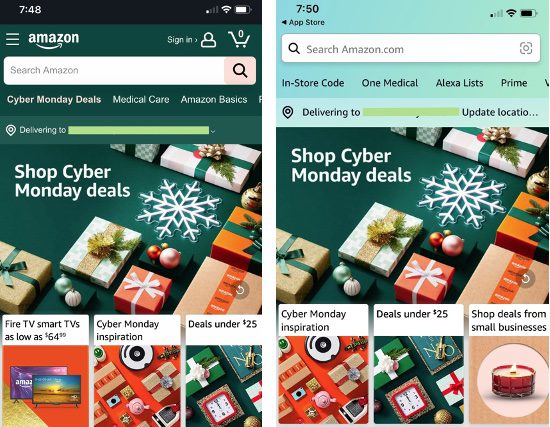

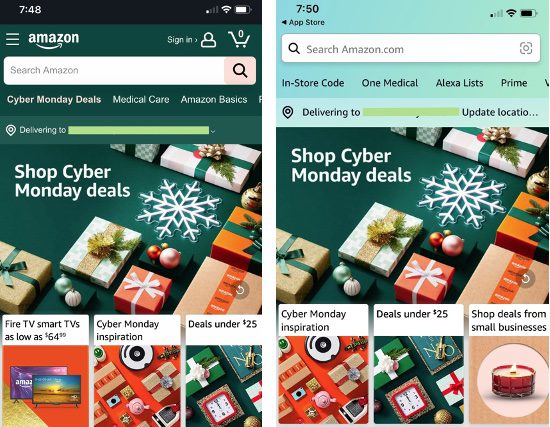

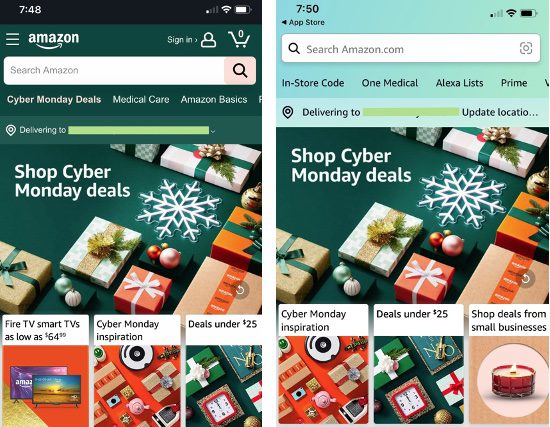

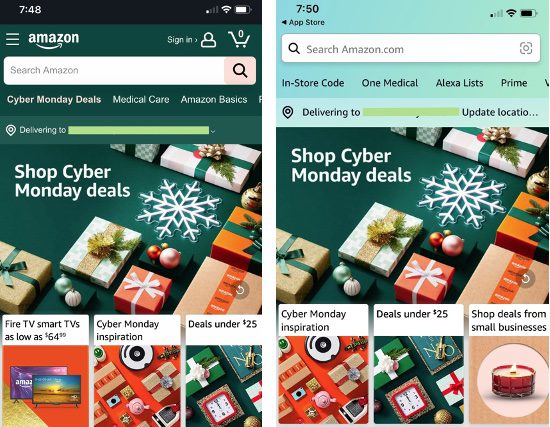

In 2018, many more Amazon mobile shoppers used the app than the website. Here are the home pages of both in 2023, with the website on the left.

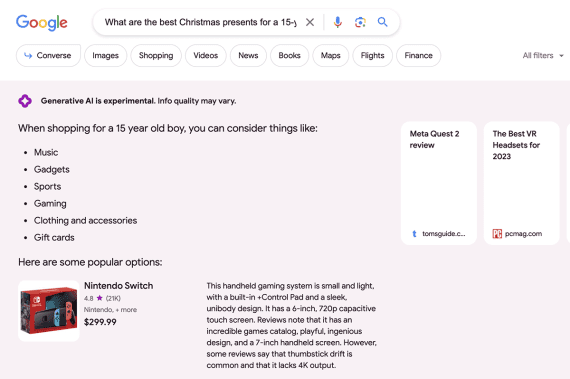

As mobile accounts for a greater share of ecommerce sales (again, 51.2% this holiday season) and ecommerce becomes an increasing part of total retail sales (15.6% in Q3 2023), more shoppers could start a purchase journey on a mobile app — like Amazon’s — instead of a dedicated search engine.

SMBs might need to entice shoppers to download their mobile apps or ensure their items appear in the most popular marketplace apps, such as Amazon, via product listings or advertising.

Conversion rates. Despite generating more revenue, mobile devices have much lower conversion rates.

For example, on Thanksgiving Day 2023, desktop visits converted at 4.4%, while mobile shoppers converted at 2.3%, per Adobe. On Black Friday, those rates were 6.5% and 3.2%, respectively.

So why does it take about twice as much traffic on mobile to generate a sale? It’s likely the shopping experience or the context.

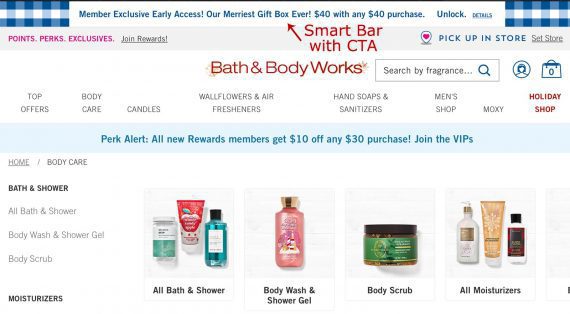

Closing that gap — and elevating return on ad spend — will be vital for merchants.

Average order value. Mobile purchases tend to include relatively fewer items than desktop, according to Adobe. In the lead-up to Black Friday 2023, Americans on average purchased between 2.6 and 2.9 items on smartphones and 3.2 and 3.9 on desktops.

Average order values likely follow a similar pattern. Hence boosting mobile AOVs will be a priority for merchants given the cost impacts on shipping, packaging, or even customer acquisition.

Mobile optimization. For years Google and other search engines have used mobile-first indexes. So optimizing a site for mobile rankings and conversions should be old hat.

To confirm, check your site’s percentage of traffic and conversions from mobile. Does either trail the industry?

A Mobile Christmas

If Thanksgiving Day and Black Friday trends continue, U.S. Christmas shopping in 2023 will reach a milestone. More than 50% of sales will come from smartphones. Next year the percentage will presumably be higher.