GA4 Five Years Later: The Current State Of Marketing Analytics

As a marketing specialist who has gone through the transition from Universal Analytics to Google Analytics 4 on countless projects, I can confidently say that no platform migration has divided the marketing community quite like GA4.

Five years after the initial launch of GA4 in October 2020, and more than a year since the complete Universal Analytics shutdown, it’s time for an honest review of where we stand with Google’s flagship analytics platform.

The Great Migration: A Bumpy Road To The Future

When Google announced in March 2022 that Universal Analytics would stop processing data by July 2023, the marketing world was in shock. The short window between the announcement and the sunset date caught many marketers off guard, causing mild panic among companies and website owners.

What followed was one of the most contentious platform migrations in digital marketing history.

Starting July 1, 2023, standard Universal Analytics properties stopped processing hits, with Universal Analytics 360 properties receiving a one-time processing extension ending on July 1, 2024.

For many of us who had spent over a decade mastering Universal Analytics, this wasn’t just a platform change; it was the end of an era.

The fundamental shift from UA’s session-based model to GA4’s event-based architecture represented more than a technical upgrade. It was a complete reimagining of how we measure and understand user behavior.

While Google positioned this as future-proofing for a privacy-first, cross-device world, the reality on the ground was far more challenging.

The Promise Vs. The Reality

Google’s marketing pitch for GA4 was compelling: enhanced user journey tracking, privacy-compliant measurement, advanced machine learning, and more intuitive reporting.

As someone who eagerly adopted GA4 early, I was excited about these possibilities. However, the execution has been a mixed bag at best.

The User Experience Crisis

Perhaps the most important criticism of GA4 has been its user interface, with widespread negative feedback from the marketing community.

The interface complaints aren’t just about aesthetics; they’re about productivity. Tasks that took two clicks in Universal Analytics now require six or more steps in GA4. Filtering for a single page, something marketers do dozens of times daily, has become an exercise in frustration.

Data Reliability Concerns

Beyond usability issues, GA4 has struggled with data reliability problems that strike at the heart of marketing decision-making.

According to Piwik PRO’s analysis, conversion tracking discrepancies, inaccurate traffic reports, integration problems with Google Ads, and discrepancies between GA4 data and BigQuery exports have been persistent issues since launch.

These aren’t minor technical glitches; they’re fundamental problems that affect how we measure campaign performance and allocate marketing budgets.

The shift from UA’s goal-based conversion tracking to GA4’s event-based system has created confusion around what we’re actually measuring, particularly when comparing year-over-year performance.

Signs Of Progress: Recent Improvements

To Google’s credit, it hasn’t ignored the criticism. The past year has seen several meaningful updates that address some of the most pressing concerns.

Google Analytics has introduced a Generated Insights feature that summarizes trends and changes in data, helping users make quicker decisions. These insights are displayed at the top of detail reports and include action buttons for report modifications. This AI-powered analysis is genuinely helpful for identifying patterns that might otherwise be missed.

The addition of Anomaly Detection in detail reports automatically flags any unexpected spikes or dips in your data, represented as circles on your charts. For busy marketers juggling multiple campaigns, this proactive approach to data monitoring is a welcome improvement.

Perhaps most significantly for agencies and enterprises, as of March 2025, GA4 finally supports the ability to copy reports and explorations from one property to another. If you’ve ever had to manually rebuild the same custom reports across multiple client accounts, you’ll appreciate how much time this saves.

The Broader Impact On Marketing Analytics

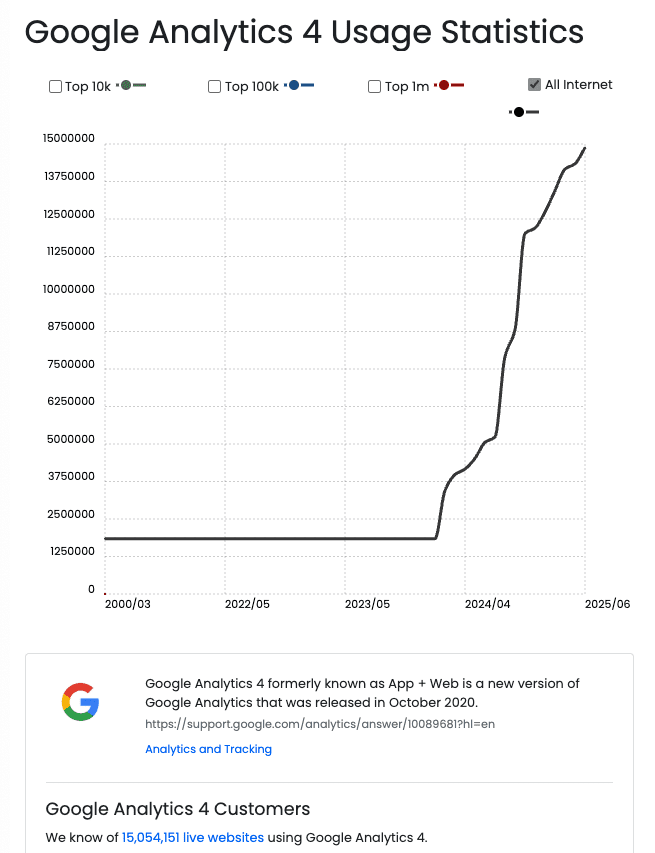

The GA4 transition has forced the entire marketing analytics landscape to evolve. Current data shows that over 15 million websites use GA4, making it the de facto standard for web analytics regardless of individual opinions about the platform.

Screenshot from trends.builtwith.com, August 2025

Screenshot from trends.builtwith.com, August 2025Looking into historical Universal adoption, more than 21 million websites used Universal Analytics, which leaves a gap to be filled. So, despite GA4 leading the analytics industry, it still has a long way to reach the former adoption rate, which creates some sort of vacuum.

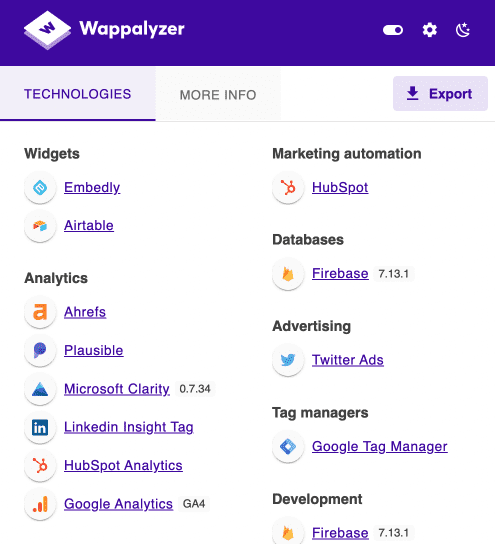

This shift has had several unintended consequences. Many organizations have diversified their analytics stack, supplementing GA4 with specialized tools that fill specific gaps. There is an increased interest in alternatives like Matomo for privacy-focused measurement and more sophisticated attribution modeling platforms for enterprise users.

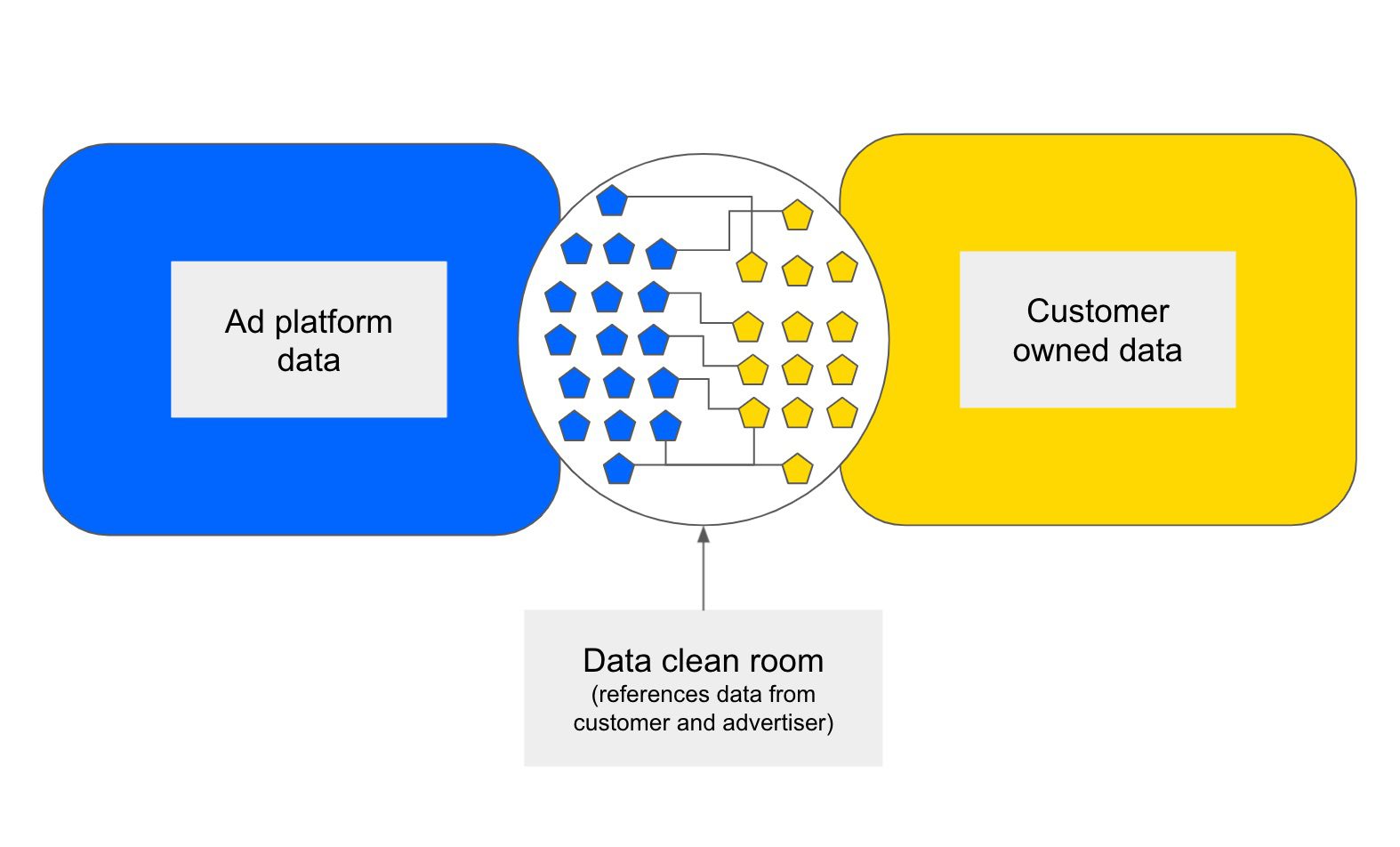

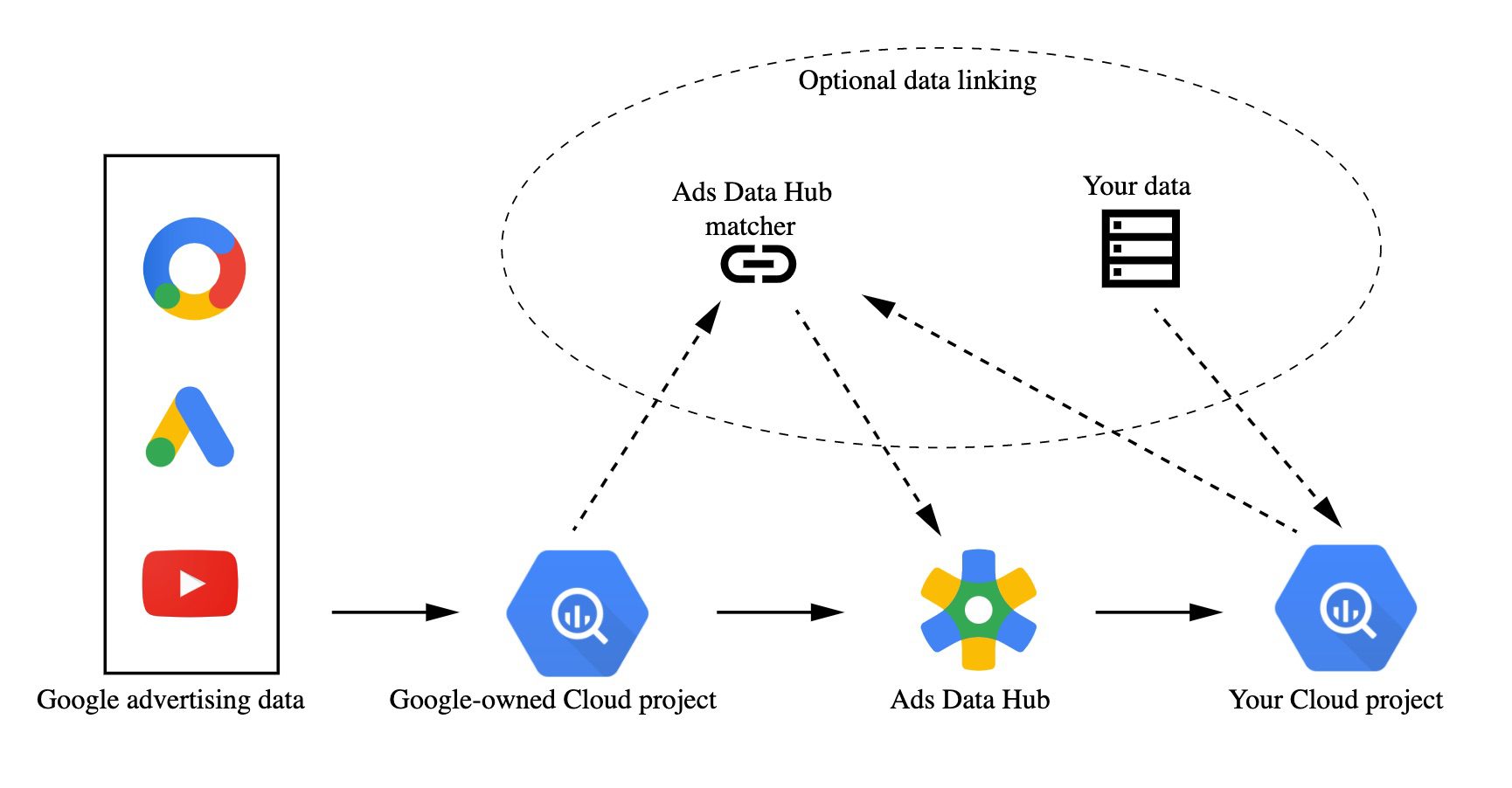

The emphasis on first-party data collection has also intensified. With the end of third-party cookies and stricter consent rules, website data coverage will decrease, limiting your leverage.

First-party data will become even more important than ever. This has pushed marketing teams to become more strategic about data collection and customer relationship building.

Practical Recommendations For Marketing Teams

After five years of working with GA4, here’s my advice for marketing teams struggling with the transition:

Invest In Education

The learning curve has been steep, but unavoidable.

As former Google Analytics team member Krista Seiden wisely noted:

“The only way to learn a new tool is to dive in and actually get your feet wet.” Budget time and resources for proper training.

Focus On Trends, Not Absolutes

When comparing year-over-year performance, focus on trends and seasonality rather than absolute numbers. GA4’s different measurement methodology means exact numerical comparisons with UA data are largely meaningless.

Supplement Strategically

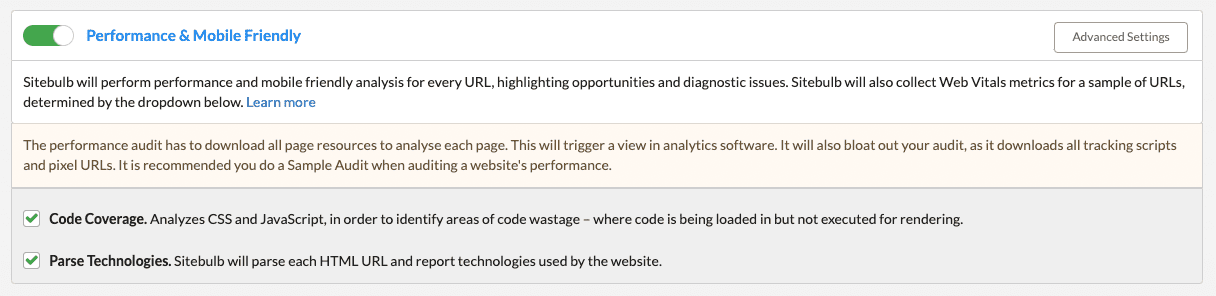

Don’t try to make GA4 do everything. Identify specific gaps in your analytics needs and fill them with specialized tools.

Many successful marketing teams now use GA4 as their foundation while leveraging additional platforms for detailed attribution, customer journey mapping, or real-time optimization.

Embrace The Event-Based Model

Rather than fighting GA4’s event-based structure, lean into it. Google recommends implementing new logic that makes sense in the event-based context rather than simply copying over existing event logic from UA. This approach will yield better insights in the long run.

Looking Forward

Cookie deprecation and enhanced privacy regulations mean that features like enhanced conversions, consent mode V2, and offline conversion tracking are now necessary rather than nice-to-haves. GA4, despite its flaws, is better positioned for this privacy-first future than Universal Analytics ever was.

The platform will undoubtedly continue improving. Google has shown responsiveness to user feedback, and the recent updates demonstrate a commitment to addressing the most pressing usability concerns. However, marketers should expect GA4 to remain more complex and technical than its predecessor.

The Bottom Line

Five years after its launch, GA4 represents both the promise and peril of modern marketing analytics. It offers capabilities that Universal Analytics couldn’t match: cross-platform tracking, privacy compliance, and AI-powered insights. Yet, it also demands a level of technical sophistication that many marketing teams struggle to achieve.

The forced migration was undoubtedly painful, and the criticism of GA4’s usability is largely justified. However, the platform is here to stay, and fighting that reality serves no one. The organizations that will thrive are those that invest in proper GA4 implementation, supplement it strategically with other tools, and adapt their processes to work with rather than against its event-based philosophy.

As marketers, we’ve weathered platform changes before, and we’ll weather this one, too. The key is approaching GA4 not as a replacement for Universal Analytics, but as a fundamentally different tool for a fundamentally different digital landscape. Once we make that mental shift, GA4 becomes less frustrating and more powerful.

The future of marketing analytics is privacy-first, cross-platform, and AI-enhanced. GA4, for all its current limitations, is our best free gateway to that future. It’s time to stop mourning Universal Analytics and start mastering what comes next.

More Resources:

Featured Image: kenchiro168/Shutterstock