Amazon Sellers: Inventory Tips & Tactics For 2024 Success via @sejournal, @AMZRobynJohnson

Inventory has always played a significant role in the way you sell on Amazon.

Running out of inventory can impact your organic ranking and can impact your advertising strategy.

Besides the potential loss of sales, poor inventory control also impacts the amount of inventory Amazon will allow you to send into the Fulfillment by Amazon (FBA) program.

Keep reading to learn more about:

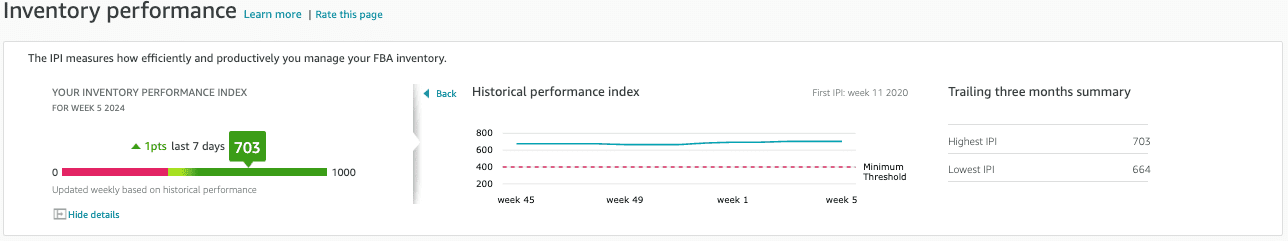

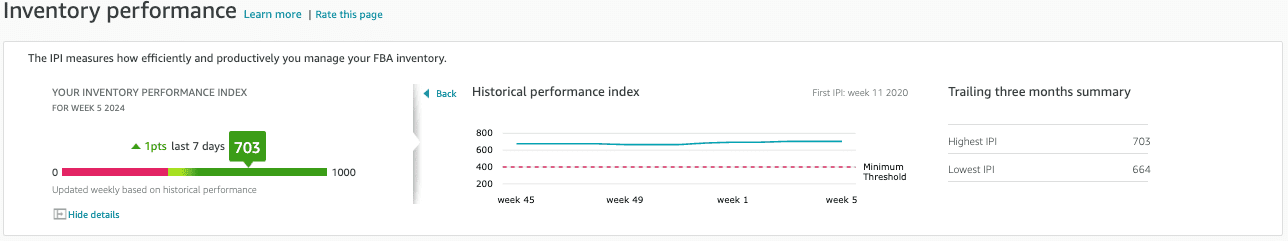

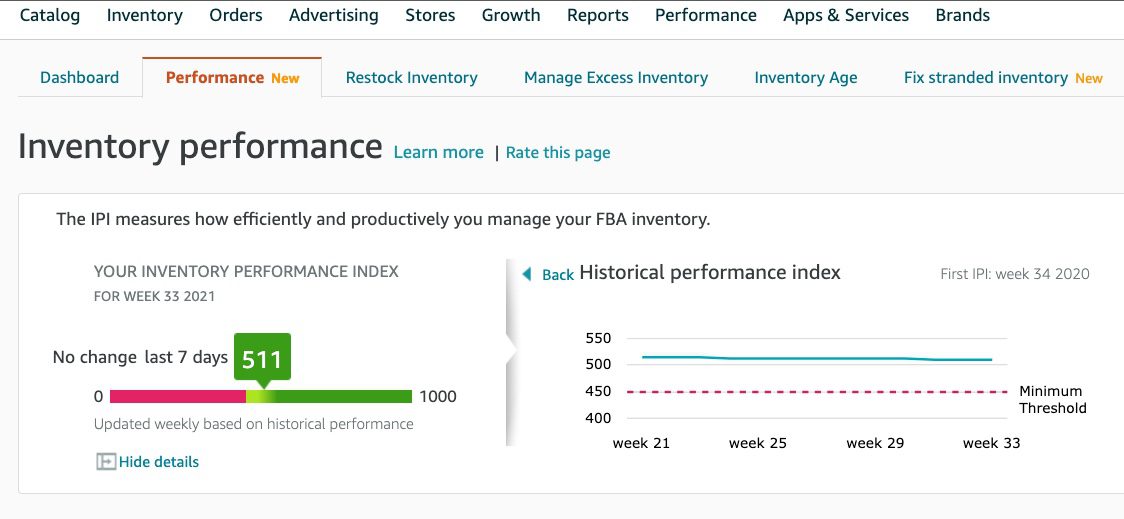

- How your Inventory Performance Index (IPI) score impacts your available storage volume.

- What the IPI is, and how it’s calculated.

- Recommended actions for improving your IPI score.

- Tips for Amazon sellers who are new to Seller Central.

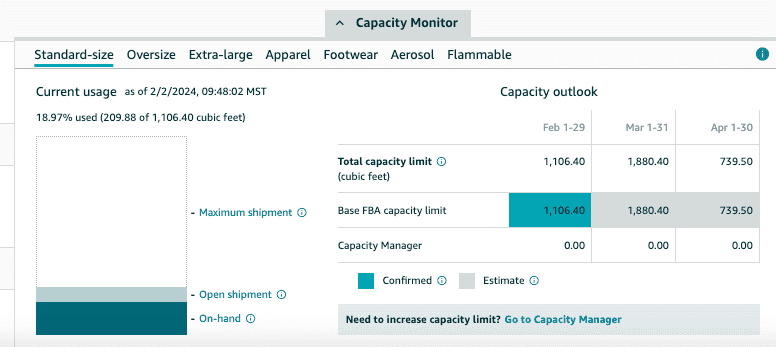

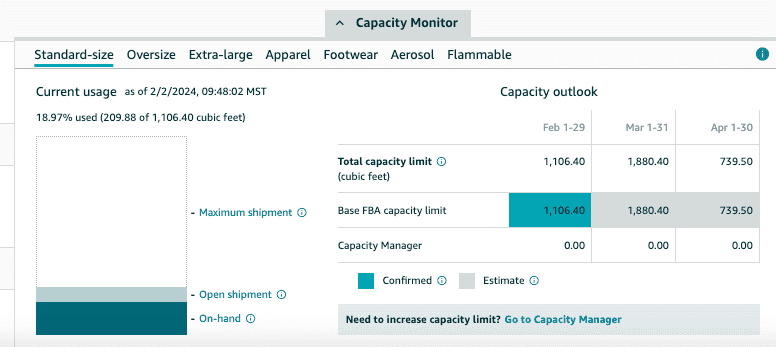

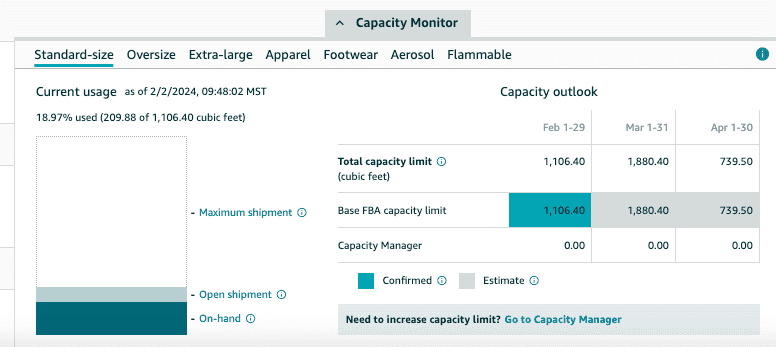

Amazon Limiting Sellers Storage Based On Storage Utilization

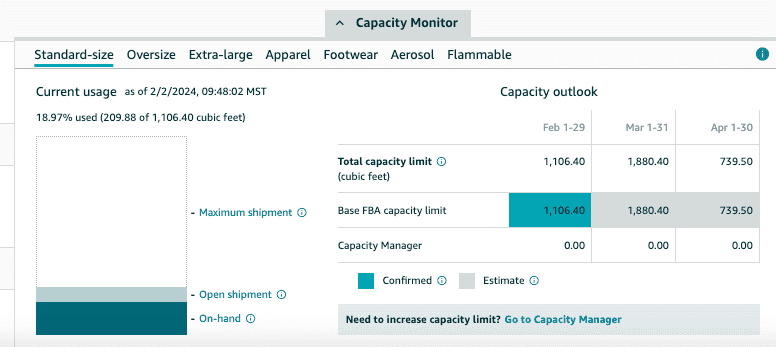

Amazon controls your storage capacity limits based on storage utilization and your sales history:

Total Capacity Limit

This limits the amount of inventory you can restock to Amazon’s FBA warehouses in one shipment and the overall maximum number of units you can store at Amazon.

Accounts that have been active for less than 39 weeks are not subject to these restrictions.

It is important to note that this is only true for those accounts on the Professional Seller Plan. Those with individual Seller Plans are limited to 15 cubic feet per month.

This limits the maximum cubic feet of storage space you have at Amazon. These limits are reviewed and adjusted monthly.

Any changes you can expect for your storage capacity for the following month will be announced on the third Monday of the month.

Included in your storage usage are the inventory currently stored at Amazon, inventory en route to Amazon, and any shipments that have been prepared but not yet sent to Amazon.

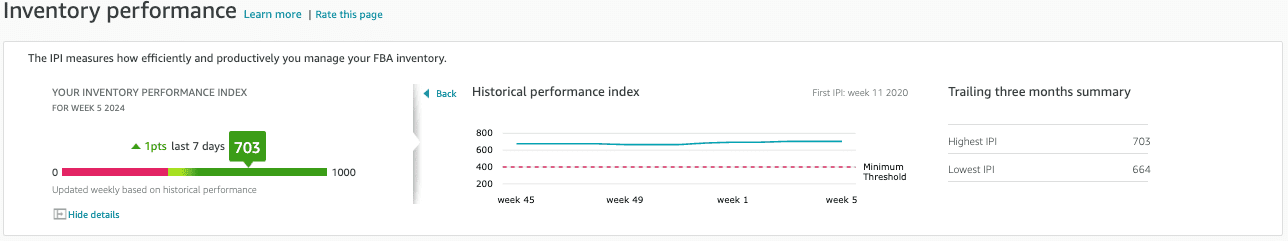

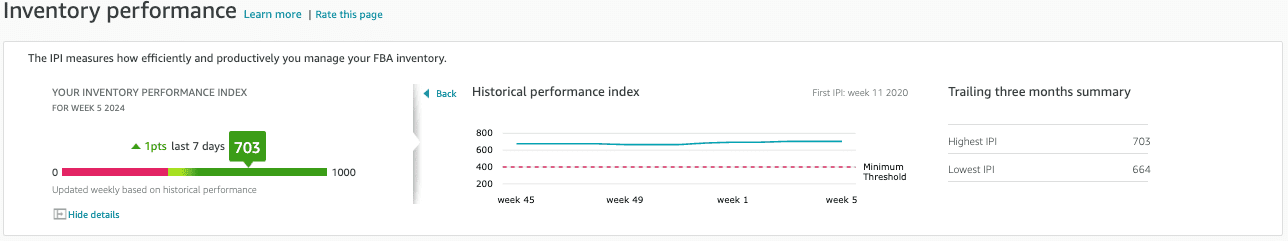

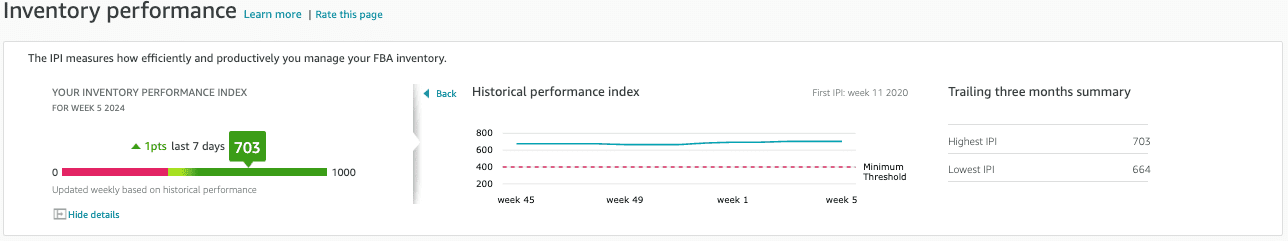

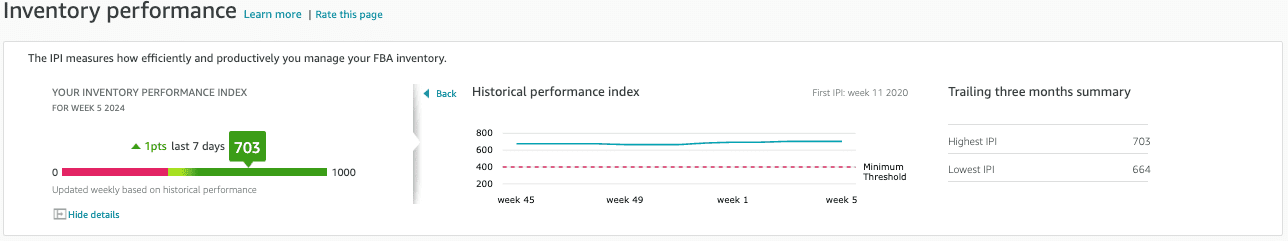

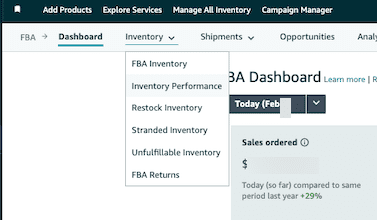

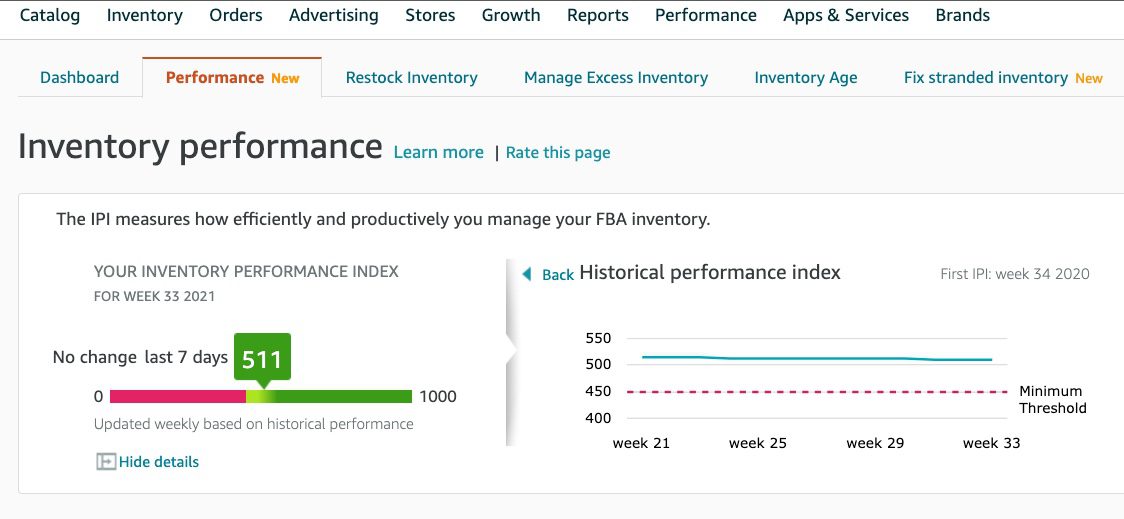

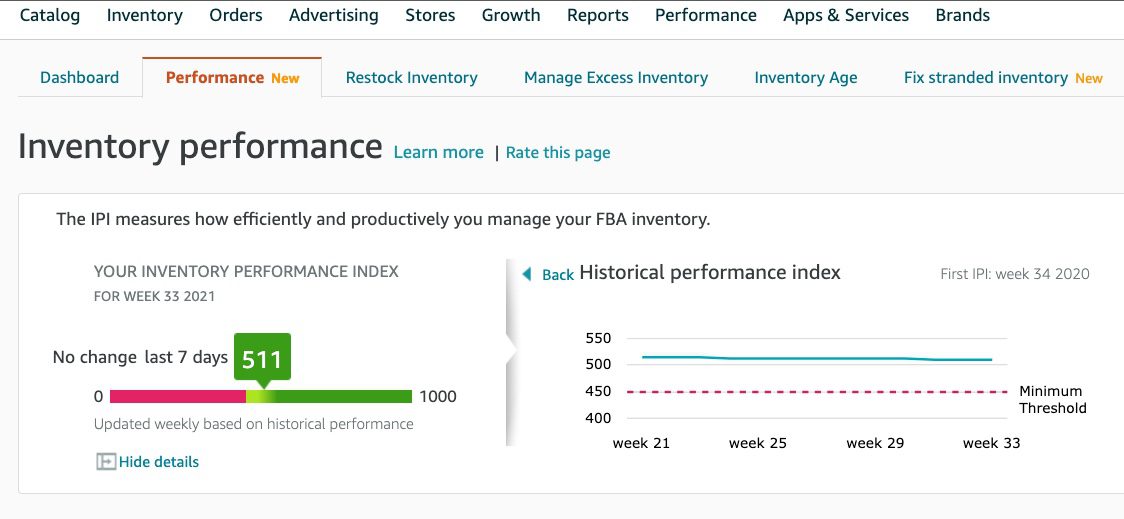

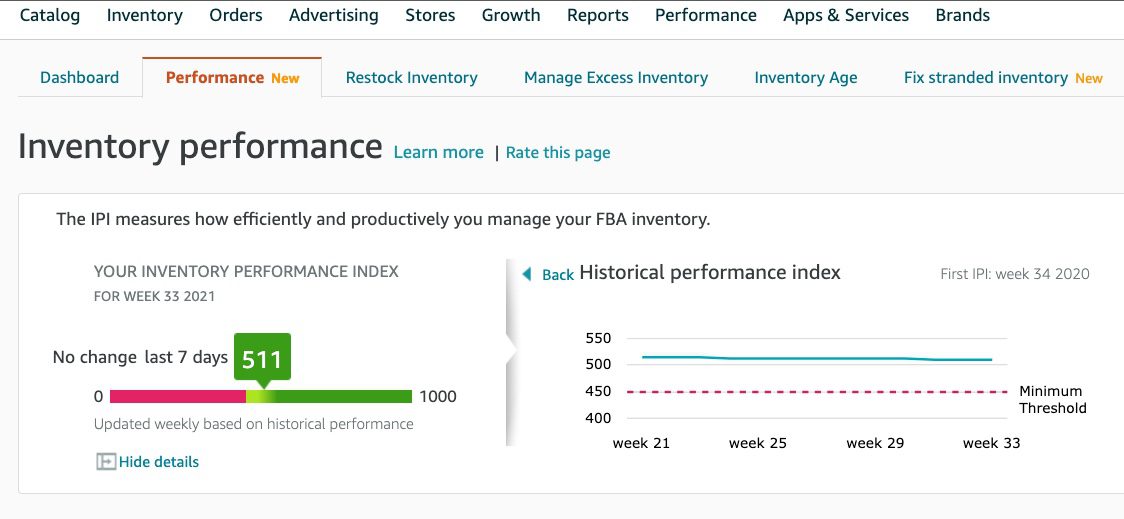

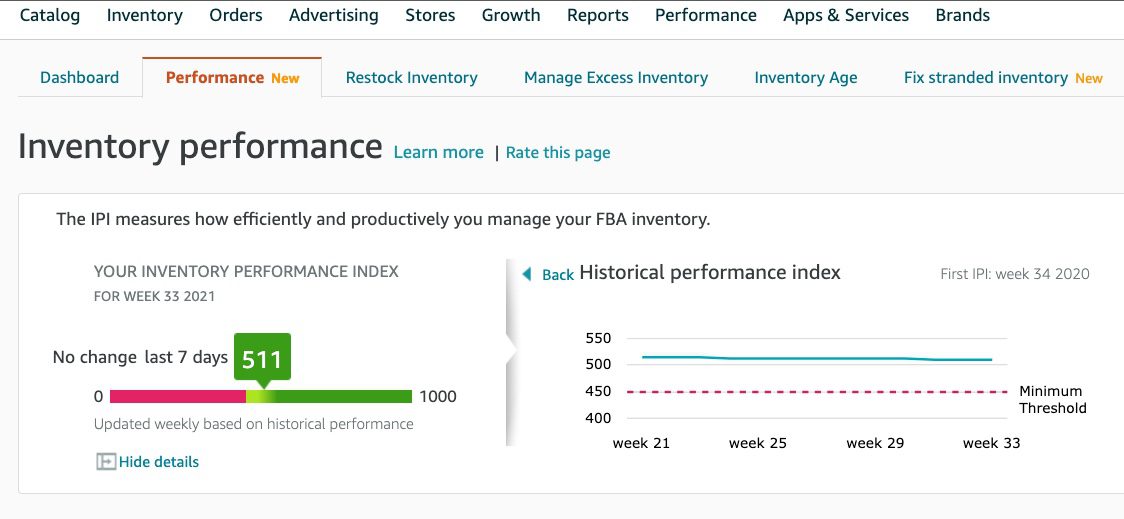

Screenshot from Amazon Seller Central, February 2024

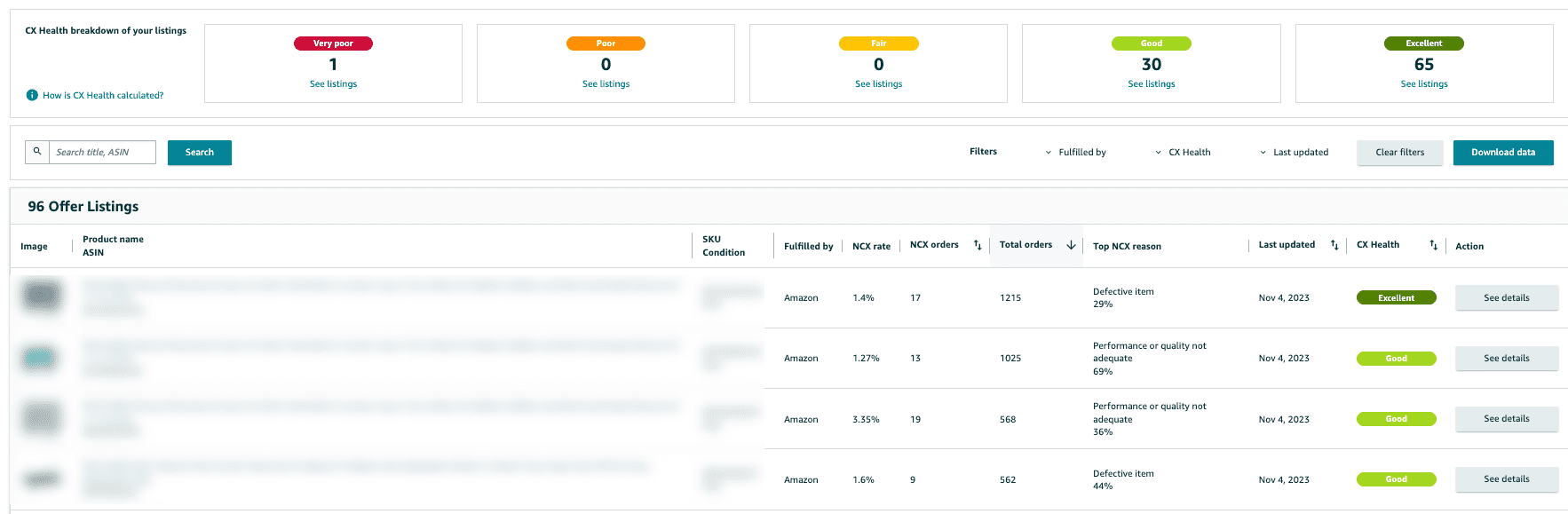

Screenshot from Amazon Seller Central, February 2024

The Storage Volume is highly impacted by your IPI (Inventory Performance Index).

We will further discuss how your IPI is calculated later in this article.

Sellers who fall below the minimum criteria can have their storage limited. Operating with such limited storage can significantly undermine your sales forecasts.

We will outline the steps you can take to ensure you have sufficient storage for your high-demand season, maximizing your sales on Seller Central.

We’ll also review what you can do if you fall below Amazon’s set criteria.

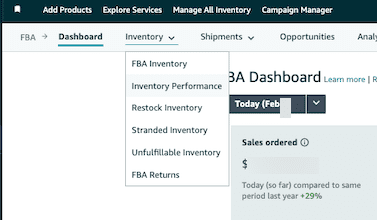

You can find your limit by going to Seller Central, selecting Inventory, navigating to the Inventory Dashboard, and then selecting Inventory Performance under the dropdown for Inventory.

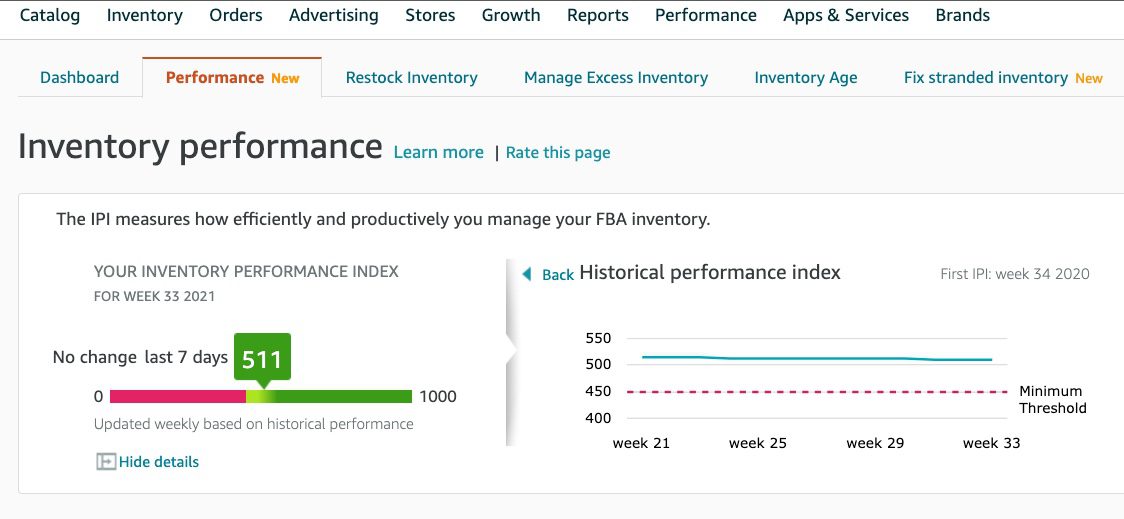

Your IPI score will be near the top of the page.

To reach your storage capacity, scroll to the bottom of the page and click on the small gray box labeled Capacity Monitor.

Success on Amazon Means You Have To Manage Your Inventory Levels Proactively

Amazon says that it considers the following criteria for your storage levels:

- IPI Score and Sales Performance: Higher storage capacities are granted to accounts that consistently achieve a high IPI score.

- Storage Utilization: In determining storage limits, Amazon considers your current inventory, inbound inventory, and shipments that are prepared but not yet dispatched.

- Sales Volume: Amazon will also look at sales volume over time.

Improving Your IPI

If you have a low IPI score, know it will take time to improve your score.

IPI is a rolling average. It can take anywhere from 2 to 12 weeks to increase your score on Amazon, so planning ahead of time is essential.

This means if your IPI is below the 400 Amazon requires, you need to start taking aggressive action today.

This article will outline how to avoid having detrimental storage limits, how it happens, and what to do when you’re already below the threshold.

For those interested in Restock Limits, we’ll explore this topic in more detail later in the guide.

What Is The IPI (Inventory Performance Index), And Does It Affect Me?

The IPI will only affect those using Seller Central and FBA warehouses.

It does not affect those using Vendor Central, Kindle Direct Platform, or those selling on Seller Central by Merchant Fulfilling or utilizing Seller Fulfilled Prime for their items.

Inventory Performance Index (IPI)

The Inventory Performance Index (IPI) manages how well you control and manage your inventory at Amazon.

This metric is a 12-week rolling average. It looks at several components over three months.

Four components make up the Inventory Performance Index (IPI):

Excess Inventory

This is the most important metric as it measures where your profitability may take a hit due to storage fees and holding costs for slow-moving FBA inventory.

Excess Inventory percentages help sellers plan when to restock more or remove inventory from FBA.

An item is considered to have excess inventory when it has over 90 days of supply based on the forecasted demand.

Sell Through Rate

This metric is just how it sounds. The formula that Amazon uses to calculate Sell Through rates is:

(Units Shipped In the Last 90 Days)/(Average Units on Hand Over the Last 90 days)

Stranded Inventory

This provides information on products that aren’t selling due to listing issues.

This occurs when your listing doesn’t meet Amazon guidelines.

In these instances, your products become stranded and unable to move while still incurring FBA storage fees.

In-Stock Inventory

Amazon looks at the percentage of time your products have been in stock during the past 30 days, with additional weight given to items that have sold more units over the past 60 days.

If you maintain a high in-stock inventory, it will result in fewer lost sales.

It is important to highlight that these components are not weighted equally.

Excess Inventory

Excess Inventory and Sell-Through Rate are the parameters that have the most significant impact on IPI, while Stranded Inventory and Restock Rates can play a minor role in the overall score.

This means you will get more movement focusing solely on the first two components rather than spreading your efforts equally across all four elements.

During the height of the pandemic, Amazon changed the minimum IPI to 500. IT has since reduced the minimum IPI back to 400.

However, Amazon can increase or decrease the minimum IPI desired score at any point in time.

For this reason, we advise our clients to aim for a total IPI of 600.

Your minimum goal should be achieving at least 50 points over the current IPI requirement.

Some product mixes make maintaining a high IPI easier than others. For example, if you are a small brand with many products that move consistently, your IPI will generally tend to be higher.

If you are a seller with a large product mix that changes often, it is the most challenging to manage.

Combatting Capacity Limits

If you’re currently experiencing a capacity limit, Amazon can increase your capacity limit for a specific period of time by submitting a request subject to Amazon’s approval.

It is important to remember that if the storage limit increase request gets approved, your account is subject to paying a “reservation fee” for each cubic foot of capacity requested, and it will get charged at the end of the specified period.

Such fee is subject to a credit depending on your sales achieved during the period (performance credits are earned at $0.15 for every dollar of sales you generate using the additional capacity.)

Another alternative is to continue selling items via merchant fulfillment or using other third-party sellers to move your inventory or send small shipments of your fastest, most profitable inventory to Amazon.

Further down in this article, we will highlight what you can do when your inventory performance is low, you are facing potential inventory limits, or if you’re new to Amazon.

Why Would Amazon Do This?

It seems like it would be counterintuitive for a company that is so focused on having as many products on its platform as possible to limit the amount of inventory you could sell.

However, as more sellers joined the platform and with rising FBA and Prime offers, overcrowding at the warehouses started to become a larger problem for Amazon.

Amazon sellers were attracted to FBA because of the low cost of storage rates. Sellers were using the FBA program as a cheap way to warehouse large amounts of inventory.

At first, Amazon tried to increase storage fees. Adding long-term storage fees dramatically increased the storage cost for merchandise aged over six months.

However, even with those changes, Amazon couldn’t curve the overcrowding and demand in its FBA warehouses.

As a result, it started to introduce storage limits in 2019.

From Amazon’s perspective, it wants to ensure customers have favorable shopping experiences and quickly get the products they want.

This means ensuring that the products most likely to sell are available.

Amazon looks at how you have managed inventory in the past and whether customers are purchasing your products to determine how much space is allocated to you.

The better Amazon feels you are at managing your space at Amazon’s FBA warehouses, the more storage space you will be allowed.

What If My IPI Is Below The Current Threshold?

If your IPI is currently below the threshold or within 50 points of the lowest threshold, these are the actions we recommend.

The first step is to check the current threshold. As of the writing of this article, the current threshold for IPI is 400.

However, here’s the direct link to the policy so you can find the current threshold, as Amazon can change this at any time. You can find the current required IPI in Seller Support under the heading FBA Inventory Storage Limits (login required).

You can review your current IPI score in Seller Central by going to Inventory, Inventory Planning, and then clicking on your IPI score.

Even with aggressive tactics, changing the IPI significantly can take 2 to 12 weeks.

Recommended Actions To Improve Inventory Performance Index (IPI)

Excess Inventory – Dump Slow Moving Items

Excess inventory is generally one of the top two reasons your IPI score could be low, since it is the most heavily weighted metric.

The first step to addressing excess inventory is to pull back inventory you don’t expect to sell.

Focus on stock-keeping units (SKUs) that have gone out of fashion or merchandise experiencing a significant demand drop, like seasonal products.

If you don’t expect it to sell within three months, you should pull back the inventory to sell on a different channel by creating a removal order.

You can also start to use the Multi-Channel Fulfillment (MCF) to fulfill your website orders from your Amazon stock.

Sometimes, it makes more sense to discount and/or advertise products to help them sell faster to remove them from your inventory rather than call back inventory from Amazon.

Optimizing a listing that is not moving can also help increase the sell-through rate.

A quick note on having Amazon destroy products – sometimes, the company will liquidate that product instead of destroying it.

If inventory control is an essential factor for your brand, we recommend pulling back the inventory even though it costs more.

While Amazon is great at logistics and moving items through its process, it isn’t great at returning items to sellers.

Often, items arrive damaged or mixed SKUs in multiple boxes, clogging up receiving departments.

If possible, we want to ensure that we’re proactively taking action to avoid pulling back inventory and risk inventory being damaged or unavailable to be sold for a long time.

Sell-Through Rate – Send Fast-Moving Items

Amazon looks at this to identify whether the items you’re selling are things customers want to purchase.

The way that we improve the sell-through rate is to send in small shipments of items that will sell out very quickly.

If you’re currently using LTL or FTL, we recommend that you move to small parcel shipments during this process so that you can send more frequent shipments without going out of stock for long periods.

As you’re restocking items, you want to prioritize those that will move quickly, sending small quantities of items that will sell out as soon as they arrive or shortly after.

This allows your overall sell-through rate to increase dramatically and significantly impact your overall IPI.

It is vital that no matter how fast you think a product will move through, as you send these products in, you’re testing small batches to make sure that things will sell at the pace you anticipate.

Stranded Inventory

Inventory that’s being held in FBA warehouses and not available for sale affects your overall IPI.

Fixing stranded inventory can make a slight difference; however, if you need to move your IPI significantly, this component of the overall metric will only make a slight difference.

It would be best to address stranded inventory weekly or bi-weekly, depending on your general sell-through rate.

In-Stock Inventory

This is probably the most frustrating metric of the IPI because, basically, Amazon is telling you that you can’t restock items because they’re not selling fast enough.

At the same time, it’s trying to encourage you to ensure you stay in stock.

We have found that this metric is very lightly weighted, and you’re better off focusing on the two key metrics of excess inventory and sell-through rate.

There has been some debate about whether deleting previous SKUs can increase this; however, we have not seen that this significantly impacts the total IPI.

General IPI Notes

As you’re working to increase your overall IPI, it is important to remember that it can take several weeks to increase.

The IPI is an average calculated over 12 weeks.

You must give the IPI enough time to move before determining whether your actions are making a difference.

It can be tempting to check your IPI often. However, your IPI score is only recalculated once a week.

If you need to raise your IPI quickly or by a significant amount, you may need to take overly aggressive actions in pruning your inventory and pumping fast-moving items through your account to increase your score to the required amount.

You might have to also bid for a capacity increase.

You should only do this if you have the data to support being able to sell through that higher quantity of items so you do not incur extra charges.

Additional Options To Combat Low IPI and Storage Capacity Issues

Sometimes, this means utilizing third-party sellers to ensure that inventory can be available to customers with a Prime offer.

Some of the brands we work with have focused on selling their fastest-moving SKUs while they improve their overall IPI score and capacity limits.

Then, they utilized third-party sellers to carry their slower-moving items while they worked on increasing their averages.

We have several reliable third-party resellers we refer our clients to if it’s ever an issue.

This means that those accounts saw a faster increase in storage capacity as they were sending in inventory that was selling at a much faster rate and restocking regularly.

If you don’t want to utilize third-party sellers, the alternative is to increase your total number of merchant-fulfilled offerings.

Remember that Merchant Fulfilled offerings generally don’t compete well against FBA offers, so watch your competition to determine feasibility.

While many brands avoid third-party sellers because it may reduce control over their brand, in this instance, it can be an excellent tool to ensure that you don’t lose potential market share to other competing product lines.

Another step you can take is to allocate your FBA warehouse space to items with the highest margin and smallest dimensional size, as they are highly profitable and sell quickly.

Leaving items with lower profitability or moving slower through Merchant Fulfilled (MF).

Tips For New Amazon Sellers

If you’re a new seller coming to Amazon or moving from Vendor Central to Seller Central, start by sending small quantities at first.

You have a grace window of 39 weeks when opening your account.

However, you want to ensure you send in small amounts of inventory. A few cases per product can help you identify the overall sell-through rate.

There is no minimum for sending inventory into Amazon FBA. So, it is possible to test as little as one unit at a time to test products on Amazon.

Sending in small shipments does increase your overall shipping cost and can reduce profitability in the short term.

However, when you’re first investigating the platform, sending in smaller quantities can help you better understand your product’s demand and help avoid additional fees that can be required to call inventory back or pay for storage fees.

Once you have a better idea of your sell-through rate, you can start to increase the total sizes of your inventory.

It is a delicate balance to have enough inventory so that you don’t run out of stock but also that you don’t have excess inventory.

While, in general, you want to aggressively avoid stockouts, the impact of a low IPI score should take priority.

Monitoring Inventory Matters

To succeed on the platform, you must take an active role in your Amazon inventory management.

In prior years, simply avoiding restocks was enough.

However, these new requirements require a greater focus on monitoring your sell-through rate and storage utilization on Amazon.

Prepare now to support your Amazon marketing and sales goals for the coming holiday season.

More Resources:

Featured Image: Piscine26/Shutterstock

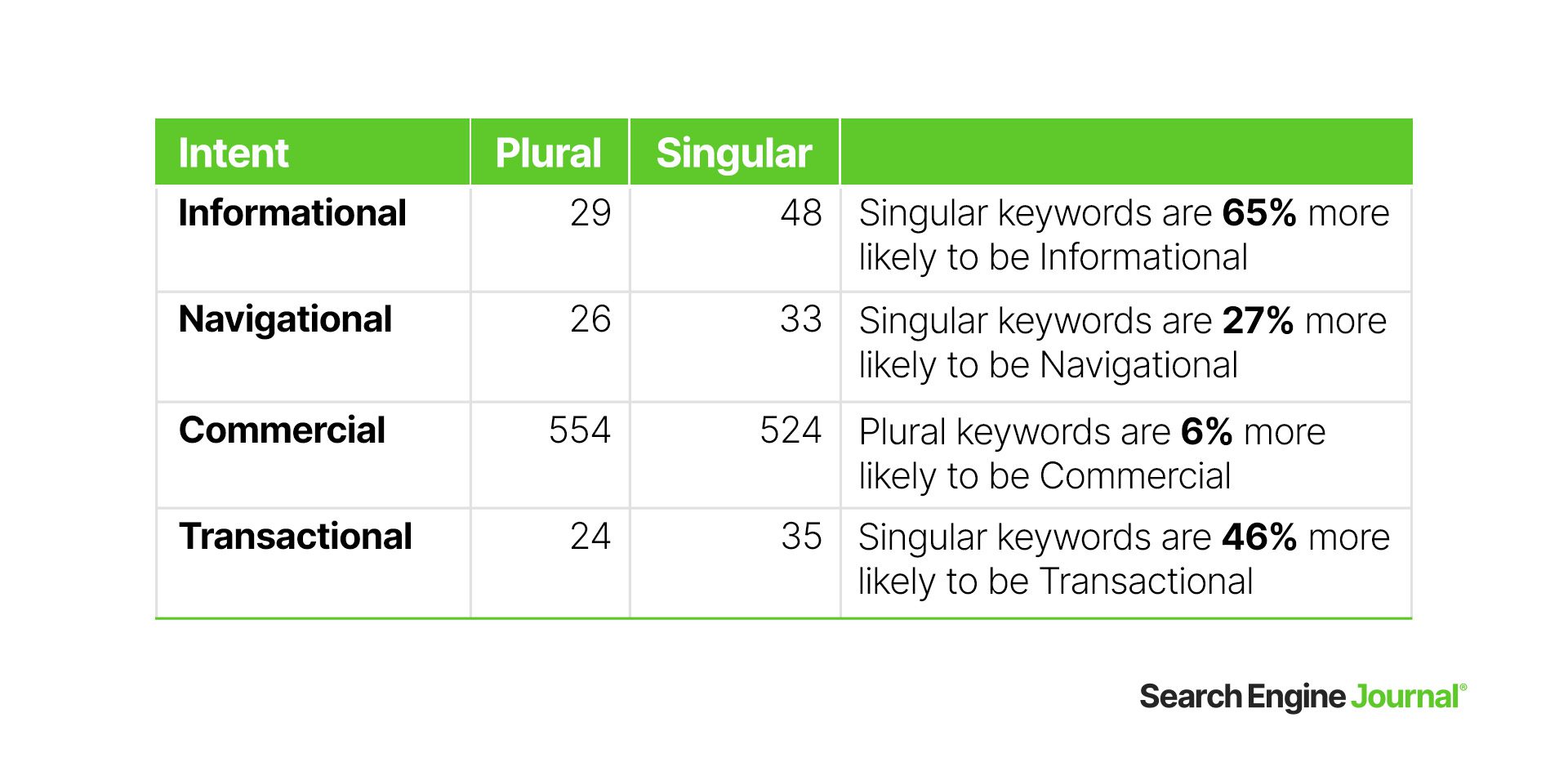

![How Plural Keywords Impact Search Intent For Ecommerce [Data Study]](https://ecommerceedu.com/wp-content/uploads/2023/09/1-64f72a4c49810-sej.jpg)

![How Plural Keywords Impact Search Intent For Ecommerce [Data Study]](https://ecommerceedu.com/wp-content/uploads/2023/09/2-64f72a3df0c85-sej.jpg)