Many agencies and marketers believe that success in paid media is primarily down to the quality of your ads or the specificity of your landing pages.

While those elements are important, they’re meaningless unless they sit on a foundation of alignment with client needs.

The cleanest account structure and flawless creatives may hit every platform benchmark, but any success will be short-lived if you’re not clued into what’s actually important to your clients.

Higher revenues, more profit, better lead quality, shorter sales cycles – this is what typically matters to the people paying the bills.

At JXT Group, we make sure that the foundation is laid before building a single campaign by gathering a clear picture of how our clients make money, who their ideal customers are, and what a proper conversion looks like.

Here are the five phases we use to engineer that experience.

1. Understand The Business Model

Financially, most Google Ads clients can be split into one of two business models: those that sell products at face value and those that want leads who convert at a later date, typically through an offline interaction.

Verticals like ecommerce and info products sell their goods (physical or otherwise) at face value, allowing you to see revenue figures inside of Google Ads.

Verticals like local services and SaaS rely on capturing interest in the form of phone calls, form fills, and chat sessions. These leads may or may not turn into actual sales later.

Anyone dealing with physical products also has to factor cash flow, procurement costs, shipping fees, and return rates into both how much they can spend as well as how much return they need on their ad spend.

This means that the same 4x return on ad spend (ROAS) can be great for one brand with low expenses, but put another underwater.

It’s why you cannot use platform metrics like ROAS while ignoring what actually results in net profit after fulfillment.

And leads need to be both high in quality and catered to promptly; otherwise, brands run the risk of low final conversion rates.

As marketers, we want to drive the right type of leads at a cost that matches a client’s close rates and order values, resulting in longer feedback loops and tighter customer relationship management (CRM) integration so we can optimize to actual revenue.

2. Match Goals To Client Priorities

Simply put, not every client is chasing the same outcome.

Some want to scale aggressively and are comfortable with a higher cost-per-acquisition (CPA), while others are laser-focused on efficiency and won’t move unless the numbers are dialed in.

I’ve worked with brands whose main goal was a clean presence, ensuring their ads show only on high-quality placements and live up to their internal values.

There are other niche goals, like outbidding a certain competitor or positioning themselves with a certain audience. All of these are valid, but they require different approaches.

Obviously, you can’t do anything until you figure out what matters most to the client. It might sound obvious, but too many agencies make assumptions based on platform key performance indicators (KPIs).

Just because Google says a campaign is performing “well” doesn’t mean it’s aligned with your client’s goals.

We start by asking the right questions, such as:

- What would success look like six to 12 months from now?

- Is your first priority profitability, growth, market share, or brand presence?

- Would you rather trade volume for efficiency or efficiency for volume?

Once that’s established, we structure everything else around it:

- How much budget is required.

- Which campaign types to run and how to structure them.

- What bid strategies we use.

- How broad or narrow our targeting needs to be.

- Messaging on ads and landing pages.

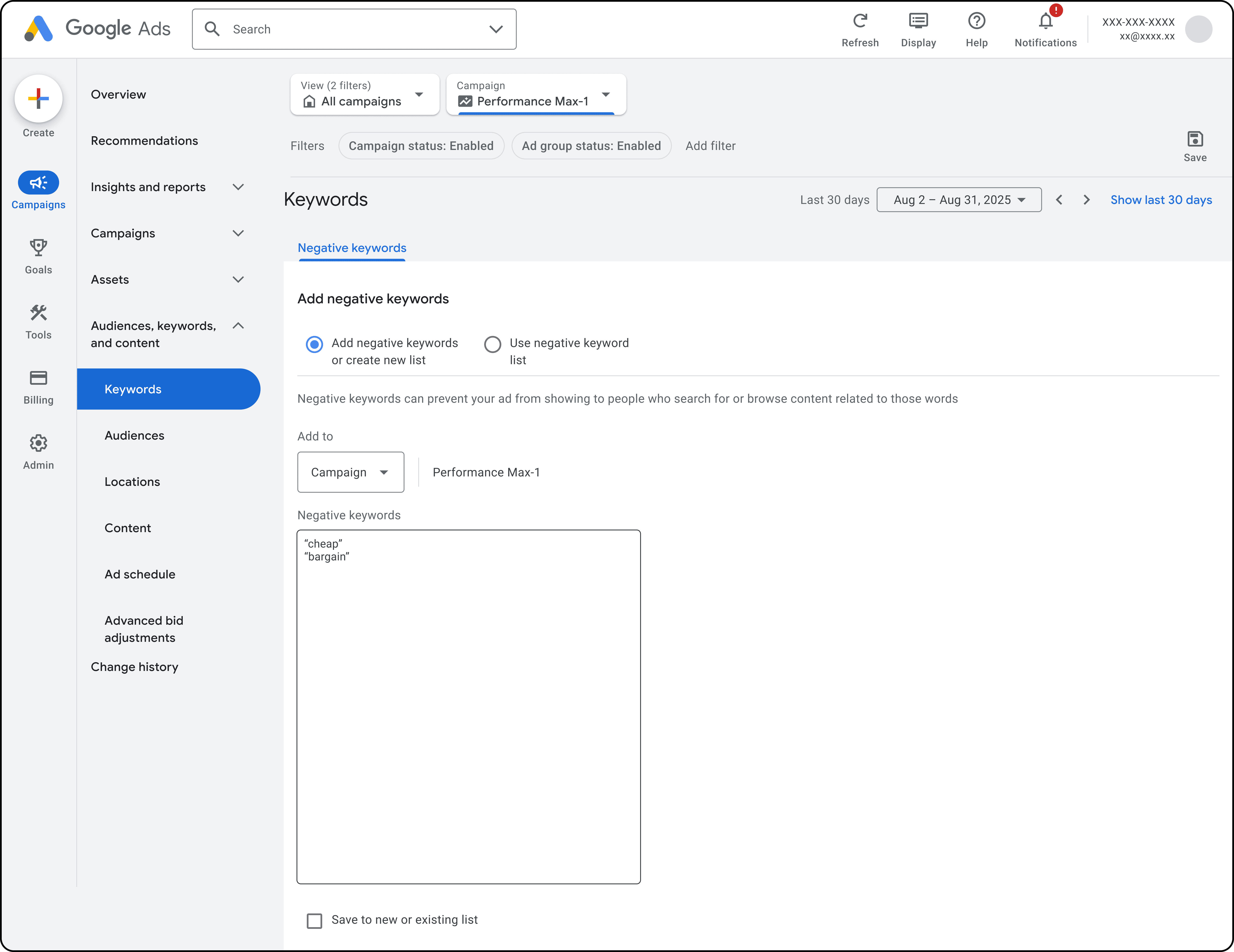

- Negative keyword lists.

- Targets for impression share, ROAS/CPA, and other KPIs.

Without these first foundational layers, everything else you do is just guesswork.

3. Set Comprehensive And Specific Goals

Once we understand the client’s business model and goals, it’s time to layer in our expertise. This part involves setting realistic goals that balance client desires with what we know is possible.

We’ll typically call on our vertical knowledge, experiences with past clients, and our understanding of unit economics and fulfillment to paint a complete picture.

There’s no room for mistakes like setting an arbitrary ROAS goal without asking what that revenue actually does for the business. After all, a 3x ROAS doesn’t mean much if the margins are thin or there are hidden costs later on.

With lead generation, the conversion doesn’t end with our intake form. In fact, it’s only the first step. The real value happens offline, when the lead turns into a paying customer, and Google has no visibility.

That gap is where the greatest insights and opportunities lie, and it’s vital that we account for it.

Here’s how to goal-set so that media performance ties back to real-world business needs.

Ecommerce

1. Look at the numbers behind the numbers.

This means breaking down the client’s cost structure.

What’s the cost of goods sold? How much does shipping cost per order? Are there fulfillment fees, returns, or seasonal procurement issues? How many other vendors get paid whose fees need to be accounted for in the ROAS target?

These offline costs directly impact ad sustainability.

2. Understand margins at the SKU or category level.

Not every product has the same margin, so some items can scale at a lower ROAS while others need to stay profitable at first touch.

We try to segment products by margin so we can set different targets where it makes sense.

3. Factor in blended performance.

A customer might enter the funnel through Google Ads but convert through another channel, like email.

We’ll study how Google fits into the entire ecosystem rather than trust a narrow window of last-click attribution, so that we can temper expectations based on how it all fits together.

4. Set realistic ROAS targets.

Once we understand the financials, it’s time to work backwards.

What’s the minimum ROAS needed to break even? What target ROAS will let the brand hit profitability goals?

This becomes our baseline and gives us a platform from which to build situational variance for things like seasonal demand, new product launches, and what competitors are doing.

5. Clarify the business objective behind the spend.

Not all brands spend on ads for the same reason. Some want to acquire new customers, others want to clear out inventory, and others still are launching a new product or range.

Each of these goals needs its own approach to bidding, creative, and measurement.

Lead Generation

1. Map the full conversion journey.

What happens after a lead submits a form or makes a call? Who follows up, how quickly, and what’s the typical close rate?

There is a full post-click sales flow that exists after someone registers their interest. If we don’t understand it, we’re optimizing in the dark.

2. Quantify the value of a lead.

Different leads have different values, and Google is not privy to any of this unless you share that data back as offline conversions.

For lead gen clients, we look at historical data on how many leads turn into sales and how quickly, what the average deal size is, and what the margin looks like.

Then, we set up integrations between Google Ads and their CRM to feed this data back and optimize against it.

3. Use the funnel to set a target CPA.

Once we know things like typical deal value and close rate, we can reverse engineer our way to a CPA that leaves enough margin on the plate.

For example, needing 30 leads to close one deal worth $1,000 gives us very limited margins and runs the risk of blowing through the market.

A client that closes 1 in 10 leads with a $5,000 average sale gives us a much higher ceiling on what they can pay per lead while staying profitable.

4. Control anything we can post-click.

Lead gen gives us a greater opportunity to influence conversions after they click. This means landing page user experience and messaging, form length and format, automated email follow-ups, and CRM workflows.

Small changes here can have an outsized impact on close rates and lead quality.

4. Employ Active Listening During Conversations

Meeting with a new client is a bit like hanging out with someone new for the first time. They might not be willing to dive deep or share as openly as we’d like, but it’s our job to make them feel comfortable enough to do so.

Surface-level answers will only take us so far. To set a truly solid strategy, we want to listen to what’s in the spaces between their words.

What are they really trying to solve? Are they really after more profit or market share, or do they just want cleaner reporting now that they have investors to answer to?

A client might say they want “more leads” when what they really need are better leads that their sales team can actually close, but you’ll never see that light if you take everything they say at face value.

Active listening shows up in the details:

- Picking up on how the client talks about their sales process, not just the form submission.

- Hearing concerns about inventory issues before pushing hard on a best-seller.

- Noticing when a CEO cares more about market visibility than ROAS.

It’s a skill that takes time to develop, but it’s also the only way to avoid misalignment and really build trust.

Get this right, and your client will feel like you’re there to make them look great and are willing to run through brick walls for them.

5. Ask Probing, Leading Questions To Reveal The Full Picture

Potential clients who put up walls need you to cut through the noise.

These questions will help you get to the real motivation behind their desire to spend on paid search, as well as allow you to spot red flags that might indicate a difficult client.

Business Direction

- What would success look like to you in the next six to 12 months? This helps them move beyond “more leads” or “better ROAS” and focus on outcomes.

- If Google Ads disappeared tomorrow, what would break in your business? This reveals how critical paid media is to their revenue engine.

- Is this about profitability, growth, or positioning? Few clients won’t say “all three,” but keep pressing, and they’ll tell you what they’d sacrifice first.

- Are you looking to maintain, grow, or exit? You should know if they’re scaling to sell, which changes everything about risk tolerance and KPIs.

Finance & Economics

- What’s your average profit margin after all costs, e.g., ads, fulfillment, labor? If they don’t have this information ready and can’t/won’t source it, that should be a red flag about their openness.

- What do you pay to acquire a customer? What’s the most you can afford to pay? See if they’re thinking in terms of lifetime value or just looking at front-end performance.

- Do we need to factor in any fixed costs that most media buyers wouldn’t know about? It opens the door to discussions about warehousing, returns, sales commissions, etc.

Lead Quality & Sales Process

- What do you consider to be a “qualified” lead? This forces them to define quality, which is far superior to treating all leads the same or leaving the definition vague.

- What happens after a lead comes through? You want to know how long it usually takes to close a deal and what their team does to facilitate that. The answer will show you how strong or weak their internal follow-up process is.

- How often do you listen to sales calls or review what’s happening post-click? If the answer is never, it tells you the magnitude of the support they’ll need to improve close rates. This might not be something you can control.

Bottlenecks & Internal Dynamics

- Who has the final say on marketing and business decisions? You’ll avoid many headaches and painful back-and-forth by establishing this upfront.

- What have you tried in the past that didn’t work, and why not? Ask this to get insight into previous agency relationships, internal friction, or unrealistic expectations.

- If we start today and in six months you’re unhappy, what will have gone wrong? This one is gold as it can expose fears, past traumas, and give you a roadmap on how to hit alignment.

But, even if you get all these answers and follow all the advice in this article, communication with your clients is the key to establishing a relationship where you’re trusted and given space to operate.

Without proactive and consistent two-way communication, their perceptions may not align with what you’re doing.

Remember: You’re The Expert, But You’re Not In Charge

One thing many agencies and marketers tend to forget as they manage thousands and millions of dollars in ad spend is that we build on leased land. These are not our accounts and campaigns, and we don’t pay the advertising bills.

So, even though it’s important for clients to defer to our expertise, ultimately, they’re the ones who call the shots when it comes to direction and strategy.

The other angle to this is that it’s not our job to make ourselves look good or even to get a solid case study out of an engagement; those are bonuses.

Our job is to service client needs, maximize results within the spend allocated to us, and make our clients look phenomenal in front of the people they answer to.

More Resources:

Featured Image: ugguggu/Shutterstock